Motorola 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

customers. However, the segment did not see any significant impact on their business in 2004 due to these

consolidations.

Government and Enterprise Mobility Solutions Segment

The Government and Enterprise Mobility Solutions segment designs, manufactures, sells, installs and services

analog and digital two-way radio, voice and data communications products and systems to a wide range of public-

safety, government, utility, transportation and other worldwide markets, and participates in the market for

integrated information management, mobile and biometric applications and services. The segment also designs,

manufactures and sells automotive electronics systems, as well as telematics systems that enable communication and

advanced safety features for automobiles. In 2005, the segment net sales represented 18% of the Company's

consolidated net sales, compared to 20% in 2004 and 24% in 2003.

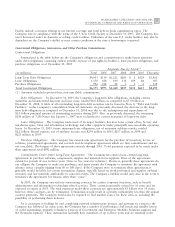

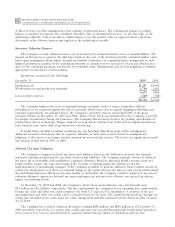

Years Ended December 31 Percent Change

(Dollars in millions)

2005

2004 2003

2005Ì2004

2004Ì2003

Segment net sales $6,597 $6,228 $5,568 6% 12%

Operating earnings 882 842 663 5% 27%

Segment ResultsÌ2005 Compared to 2004

In 2005, the segment's net sales increased 6% to $6.6 billion, compared to $6.2 billion in 2004. The increase in

net sales reflects increased sales to the segment's government and enterprise markets, partially offset by a decrease

in sales to the automotive electronics market, driven primarily by weak automobile industry conditions. The

increase in net sales in the government market was driven by increased customer spending on enhanced mission-

critical communications and the continued focus on homeland security initiatives. The increase in net sales in the

enterprise market reflects enterprise customers' demand for business-critical communications. The overall increase in

net sales was driven by net sales growth in the Americas and Asia.

The segment's operating earnings increased to $882 million in 2005, compared to operating earnings of

$842 million in 2004. The 5% increase in operating earnings was primarily due to a 6% increase in net sales. This

improvement in operating results was partially offset by: (i) an increase in SG&A expenditures, (ii) an increase in

reorganization of business charges, primarily relating to employee severance, and (iii) an increase in R&D

expenditures, driven by increased investment in next-generation technologies across the segment.

Net sales in North America continue to comprise a significant portion of the segment's business, accounting

for 69% of the segment's net sales in both 2005 and 2004. The principal Automotive customers are large

automobile manufacturers, primarily in North America. Net sales to five such customers represented approximately

20% of the segment's net sales in 2005. The segment's backlog was $2.4 billion at both December 31, 2005 and

December 31, 2004.

Natural disasters and terrorist-related worldwide events in 2005 continued to place an emphasis on mission-

critical communications systems. Spending by the segment's government and public safety customers is affected by

government budgets at the national, state and local levels. The segment will continue to work closely with all

pertinent government departments and agencies to ensure that two-way radio and wireless communications is

positioned as a critical need for public safety and homeland security. As a global leader in mission-critical

communications, we expect to continue to grow as spending increases worldwide for mission-critical

communications systems. The segment continues to be well-positioned to serve the increased worldwide demand

for these systems in 2006 and beyond.

The scope and size of systems requested by some of the segment's customers continue to increase, including

requests for country-wide and statewide systems. These larger systems are more complex and include a wide range

of capabilities. Large-system projects will impact how contracts are bid, which companies compete for bids and

how companies partner on projects.

Segment ResultsÌ2004 Compared to 2003

In 2004, the segment's net sales increased 12% to $6.2 billion, compared to $5.6 billion in 2003. The increase

in net sales reflected: (i) continued emphasis on spending by customers in the segment's government market on