Motorola 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

denominated debt obligations including certificates of deposit, bankers' acceptances and fixed time deposits,

government obligations, asset-backed securities and commercial paper or short-term corporate obligations. The

Sigma Funds investment policies require that floating rate instruments acquired must have a maturity at purchase

date that does not exceed thirty-six months with an interest rate reset at least annually. The average maturity of the

investments held by the funds must be 120 days or less with the actual average maturity of the investments being

74 days and 64 days at December 31, 2005 and December 31, 2004, respectively. Certain investments with

maturities beyond one year have been classified as short-term based on their highly-liquid nature and because such

marketable securities represent the investment of cash that is available for current operations.

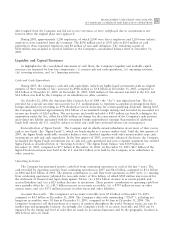

Strategic Acquisitions and Investments: The Company used cash for acquisitions and new investment

activities of $312 million in 2005, compared to cash used of $476 million in 2004 and $279 million in 2003. The

largest components of the $312 million in 2005 expenditures were: (i) the acquisition of the remaining interest of

MIRS Communications Israel LTD. by the Government and Enterprise Mobility Solutions segment, (ii) the

acquisition of Wireless Valley Communications, Inc. by the Government and Enterprise Mobility Solutions segment,

(iii) the acquisition of certain IP assets and R&D workforce from Sendo by the Mobile Devices segment, (iv) the

acquisition of Ucentric Systems, Inc. by the Connected Home Solutions segment, and (v) the funding of joint

ventures formed by Motorola and Comcast that will focus on developing the next-generation of conditional access

technologies. The largest components of the $476 million in 2004 expenditures were: (i) $169 million for the

acquisition of MeshNetworks, Inc., a leading developer of mobile mesh networking and position-location

technologies by the Government and Enterprise Mobility Solutions segment, (ii) $121 million, net of cash assumed,

the acquisition of Force Computers by the Networks segment, (iii) the acquisition of Quantum Bridge

Communications, Inc. by the Networks segment, and (iv) the acquisition of the remaining interest of Appeal

Telecom of Korea by the Mobile Devices segment.

Capital Expenditures: Capital expenditures were $583 million in 2005, compared to $494 million in 2004 and

$344 million in 2003. The increase in capital expenditures is primarily due to: (i) increased corporate spending on

facility and asset upgrades, and (ii) increased spending in the Mobile Devices segment. The Company's emphasis in

making capital expenditures is to focus on strategic investments driven by customer demand and new design

capability.

Short-Term Investments: At December 31, 2005, the Company had $144 million in short-term investments

(which are highly-liquid fixed-income investments with an original maturity greater than three months but less than

one year), compared to $152 million of short-term investments at December 31, 2004.

Available-For-Sale Securities: In addition to available cash and cash equivalents, Sigma Funds and short-term

investments, the Company views its available-for-sale securities as an additional source of liquidity. The majority of

these securities represent investments in technology companies and, accordingly, the fair market values of these

securities are subject to substantial price volatility. In addition, the realizable value of these securities is subject to

market and other conditions. At December 31, 2005, the Company's available-for-sale securities portfolio had an

approximate fair market value of $1.2 billion, which represented a cost basis of $1.1 billion and a net unrealized

gain of $157 million. At December 31, 2004, the Company's available-for-sale securities portfolio had an

approximate fair market value of $2.9 billion, which represented a cost basis of $616 million and a net unrealized

gain of $2.3 billion.

Nextel Investment: During the first half of 2005, the Company sold 22.5 million shares of common stock of

Nextel Communications, Inc. (""Nextel''). The Company received approximately $679 million in cash and realized

a pre-tax gain of $609 million from these sales. Subsequent to these sales, the Company owned 25 million shares of

common stock and 29.7 million shares of non-voting common stock of Nextel.

On August 12, 2005, Sprint Corporation completed its merger (the ""Sprint Nextel Merger'') with Nextel. In

connection with the Sprint Nextel Merger, Motorola received $46 million in cash, 31.7 million voting shares and

37.6 million non-voting shares of Sprint Nextel Corporation (""Sprint Nextel''), in exchange for its remaining

54.7 million shares of Nextel. As a result of this transaction, the Company realized a gain of $1.3 billion, comprised

of a $1.7 billion gain recognized on the receipt of cash and the 69.3 million shares of Sprint Nextel in exchange for

its shares of Nextel, net of a $418 million loss recognized on its hedge of 25 million shares of common stock of

Nextel, as described below.

On December 14, 2004, in connection with the announcement of the definitive agreement relating to the Sprint

Nextel Merger, Motorola, a Motorola subsidiary and Nextel entered into an agreement pursuant to which

Motorola and its subsidiary agreed not dispose of their 29.7 million non-voting shares of Nextel (now 37.6 million