Motorola 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

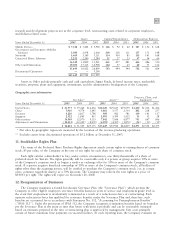

113

research and development projects not at the corporate level, restructuring costs related to corporate employees,

and Iridium related costs.

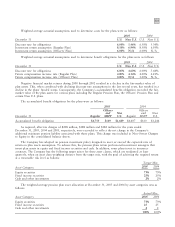

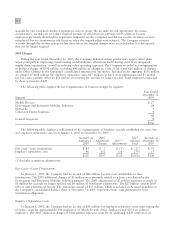

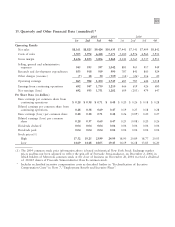

Assets Capital Expenditures Depreciation Expense

Years Ended December 31

2005

2004 2003

2005

2004 2003

2005

2004 2003

Mobile Devices $ 7,548 $ 5,442 $ 3,900 $ 126 $92$62$ 127 $ 136 $ 168

Government and Enterprise Mobility

Solutions 3,080 2,958 2,606 200 238 111 157 151 148

Networks 3,469 3,169 3,111 114 100 85 133 145 168

Connected Home Solutions 2,252 2,240 2,284 21 27 23 47 54 66

16,349 13,809 11,901 461 457 281 464 486 550

Other and Eliminations 19,300 17,113 14,908 122 37 63 68 75 114

35,649 30,922 26,809 583 494 344 532 561 664

Discontinued Operations ÌÌ 5,190

$35,649 $30,922 $31,999

Assets in Other include primarily cash and cash equivalents, Sigma Funds, deferred income taxes, marketable

securities, property, plant and equipment, investments, and the administrative headquarters of the Company.

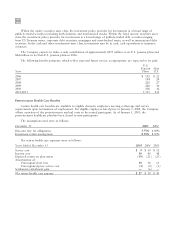

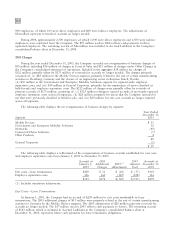

Geographic area information

Property, Plant, and

Net Sales* Assets** Equipment

Years Ended December 31

2005

2004 2003

2005

2004 2003

2005

2004 2003

United States $ 21,575 $ 19,462 $16,216 $24,128 $19,633 $19,079 $1,230 $1,304 $1,424

China 5,010 4,574 3,645 3,881 3,557 2,530 202 218 237

Germany 3,220 2,817 1,798 998 982 581 119 141 137

Singapore 2,522 1,849 815 2,993 3,389 1,612 35 32 28

Other nations 14,949 12,970 9,153 7,842 7,666 6,877 741 667 666

Adjustments and Eliminations (10,433) (10,349) (8,472) (4,193) (4,305) (3,870) (56) (30) (19)

$ 36,843 $ 31,323 $23,155 $35,649 $30,922 $26,809 $2,271 $2,332 $2,473

* Net sales by geographic region are measured by the location of the revenue-producing operations.

** Excludes assets from discontinued operations of $5.2 billion at December 31, 2003.

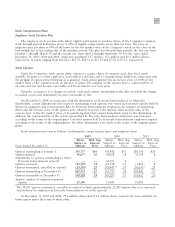

11. Stockholder Rights Plan

The terms of the Preferred Share Purchase Rights Agreement attach certain rights to existing shares of common

stock, $3 par value, of the Company at the rate of one right for each share of common stock.

Each right entitles a shareholder to buy, under certain circumstances, one thirty-thousandth of a share of

preferred stock for $66.66. The rights generally will be exercisable only if a person or group acquires 10% or more

of the Company's common stock or begins a tender or exchange offer for 10% or more of the Company's common

stock. If a person acquires beneficial ownership of 10% or more of the Company's common stock, all holders of

rights other than the acquiring person, will be entitled to purchase the Company's common stock (or, in certain

cases, common equivalent shares) at a 50% discount. The Company may redeem the new rights at a price of

$0.0033 per right. The rights will expire on November 20, 2008.

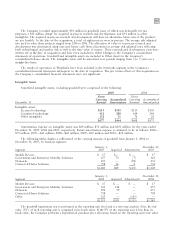

12. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the ""Severance Plan'') which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. Each

separate reduction-in-force has qualified for severance benefits under the Severance Plan and, therefore, such

benefits are accounted for in accordance with Statement No. 112, ""Accounting for Postemployment Benefits''

(""SFAS 112''). Under the provisions of SFAS 112, the Company recognizes termination benefits based on formulas

per the Severance Plan at the point in time that future settlement is probable and can be reasonably estimated

based on estimates prepared at the time a restructuring plan is approved by management. Exit costs primarily

consist of future minimum lease payments on vacated facilities. At each reporting date, the Company evaluates its