Motorola 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Inventory: The Company's net inventory was $2.5 billion at both December 31, 2005 and December 31,

2004. The Company's inventory turns increased to 11.3 at December 31, 2005, compared to 9.3 at December 31,

2004. Inventory turns were calculated using an annualized rolling three months of cost of sales method. The

increase in overall inventory turns was driven by an increase in turns by Mobile Devices, primarily due to the

significant growth in net sales and effective inventory management programs, and is evidence of benefits from the

continued focus on inventory and supply-chain management processes throughout the Company. Inventory

management continues to be an area of focus as the Company balances the need to maintain strategic inventory

levels to ensure competitive delivery performance to its customers against the risk of inventory obsolescence due to

rapidly changing technology and customer spending requirements.

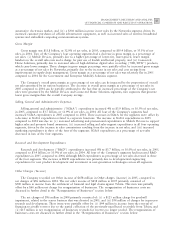

Reorganization of Businesses: The Company has implemented reorganization of businesses plans. Cash

payments for exit costs and employee separations in connection with these plans were $106 million in 2005, as

compared to $133 million in 2004. Of the $108 million reorganization of businesses accrual at December 31, 2005,

$53 million relates to employee separation costs and is expected to be paid in 2006. The remaining $55 million in

accruals relate to lease termination obligations that are expected to be paid over a number of years.

Benefit Plan Contributions: The Company contributed $370 million to its pension plans during 2005,

compared to $652 million in 2004. The Company expects to make cash contributions of approximately

$275 million to its U.S. pension plans and $44 million to its non-U.S. pension plans during 2006. The Company

contributed $43 million to its retiree healthcare plan in 2005 and expects to contribute $45 million to this plan in

2006. Retirement-related benefits are further discussed below in the ""Significant Accounting PoliciesÌRetirement-

Related Benefits'' section.

Investing Activities

The most significant components of the Company's investing activities include: (i) proceeds from sales of

investments and businesses, (ii) purchases of Sigma Funds investments, (iii) strategic acquisitions of, or investments

in, other companies, and (iv) capital expenditures.

Net cash used for investing activities from continuing operations was $2.4 billion in 2005, as compared to net

cash used of $1.7 billion in 2004 and $6.1 billion in 2003. The $699 million increase in cash used for investing

activities in 2005 compared to 2004 was due to: (i) a $1.6 billion increase in cash used for the purchase of Sigma

Funds investments, (ii) an $89 million increase in capital expenditures, and (iii) a $35 million decrease in proceeds

received from the disposition of property, plant and equipment, partially offset by: (i) an $875 million increase in

proceeds from the sales of investments and businesses, (ii) a $164 million decrease in cash used for acquisitions

and investments, and (iii) a $21 million increase in proceeds from the sale of short-term investments. The

$6.1 billion in cash used for investing activities from continuing operations in 2003 was primarily due to the initial

purchase of Sigma Funds investments.

Sales of Investments and Businesses: The Company received $1.6 billion in proceeds from the sales of

investments and businesses in 2005, compared to proceeds of $682 million in 2004 and $665 million in 2003. The

$1.6 billion in proceeds in 2005 were primarily comprised of: (i) $679 million from the sale of a portion of the

Company's shares in Nextel Communications, Inc. (""Nextel'') during the first half of 2005, (ii) $391 million from

the sale of a portion of the Company's shares in Sprint Nextel Corporation during the fourth quarter of 2005,

(iii) $232 million from the sale of a portion of the Company's shares in Semiconductor Manufacturing

International Corporation, and (iv) $96 million received in connection with the merger of Sprint Corporation and

Nextel. The $682 million in proceeds generated in 2004 were primarily comprised of: (i) $216 million from the

sale of the Company's remaining shares in Broadcom Corporation, (ii) $141 million from the sale of a portion of

the Company's shares in Nextel, (iii) $117 million from the sale of a portion of the Company's shares in Telus

Corporation, and (iv) $77 million from the sale of a portion of the Company's shares in Nextel Partners, Inc.

(""Nextel Partners'').

Sigma Funds: The Company and its wholly-owned subsidiaries invest most of their excess cash in two funds

(the ""Sigma Funds''), which are funds similar to a money market fund. The Company used $3.2 billion in net cash

for the purchase of Sigma Funds investments in 2005, compared to $1.5 billion in net cash for the purchase of

Sigma Funds investments in 2004. The Sigma Funds balance was $10.9 billion at December 31, 2005, compared to

$7.7 billion at December 31, 2004.

The Sigma Funds portfolios are managed by five major outside investment management firms and include

investments in high quality (rated at least A/A-1 by S&P or A2/P-1 by Moody's at purchase date), U.S. dollar-