Motorola 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

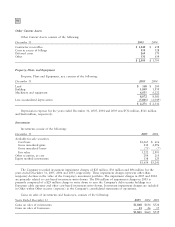

government obligations, asset-backed securities and commercial paper or short-term corporate obligations. The

Sigma Funds investment policies require that floating rate instruments acquired must have a maturity at purchase

date that does not exceed thirty-six months with an interest rate reset at least annually. The average maturity of the

investments held by the funds must be 120 days or less with the actual average maturity of the investments being

74 days and 64 days at December 31, 2005 and December 31, 2004, respectively. The Company values investments

in the Sigma Funds using the amortized cost method, which approximates current market value. Under this method,

securities are valued at cost when purchased and thereafter a constant proportionate amortization of any discount

or premium is recorded until maturity of the security. Certain investments with maturities beyond one year have

been classified as short-term based on their highly liquid nature and because such marketable securities represent

the investment of cash that is available for current operations.

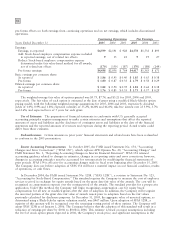

Inventories: Inventories are valued at the lower of average cost (which approximates computation on a

first-in, first-out basis) or market (net realizable value or replacement cost).

Property, Plant and Equipment: Property, plant and equipment are stated at cost less accumulated

depreciation. Depreciation is recorded using declining-balance and straight-line methods, based on the estimated

useful lives of the assets (buildings and building equipment, 5-40 years; machinery and equipment, 2-12 years) and

commences once the assets are ready for their intended use.

Goodwill and Intangible Assets: Goodwill is not amortized, but instead is tested for impairment at least

annually as of October. Intangible assets continue to be amortized over their respective estimated useful lives

ranging from 2 to 13 years. The Company has no intangible assets with indefinite useful lives.

Impairment of Long-Lived Assets: Long-lived assets held and used by the Company and intangible assets are

reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of assets

may not be recoverable. The Company evaluates recoverability of assets to be held and used by comparing the

carrying amount of an asset to future net undiscounted cash flows to be generated by the assets. If such assets are

considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying

amount of the assets exceeds the fair value of the assets calculated using a discounted future cash flows analysis.

Assets held for sale, if any, are reported at the lower of the carrying amount or fair value less cost to sell.

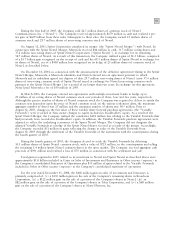

Investments: Investments include, principally, available-for-sale equity securities at fair value, held-to-maturity

debt securities at amortized cost, securities that are restricted for more than one year or not publicly traded at cost,

and equity method investments. For the available-for-sale equity securities, any unrealized holding gains and losses,

net of deferred taxes, are excluded from operating results and are recognized as a separate component of

Stockholders' Equity until realized. The fair values of the securities are determined based on prevailing market

prices. The Company assesses declines in the value of individual investments to determine whether such decline is

other-than-temporary and thus the investment is impaired. This assessment is made by considering available

evidence including changes in general market conditions, specific industry and individual company data, the length

of time and the extent to which the market value has been less than cost, the financial condition and near-term

prospects of the individual company, and the Company's intent and ability to hold the investment.

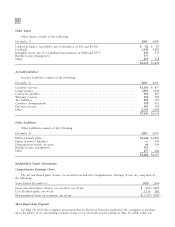

Deferred Income Taxes: Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to differences between the financial statement carrying amounts of existing assets and liabilities and

their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply

to taxable income in the years in which those temporary differences are expected to be recovered or settled. In

assessing the realizability of the deferred tax assets, management considers whether it is more likely than not that

some portion or all of the deferred tax assets will not be realized. A valuation allowance is recorded for the

portion of the deferred tax assets that are not expected to be realized based on the level of historical taxable

income, projections for future taxable income over the periods in which the temporary differences are deductible

and allowable tax planning strategies.

Finance Receivables: Finance receivables include trade receivables where contractual terms of the note

agreement are greater than one year. Finance receivables are considered impaired when management determines it is

probable that the Company will be unable to collect all amounts due according to the contractual terms of the

note agreement, including principal and interest. Impaired finance receivables are valued based on the present value

of expected future cash flows, discounted at the receivable's effective rate of interest, or the fair value of the

collateral if the receivable is collateral dependent. Interest income and late fees on impaired finance receivables are

recognized only when payments are received. Previously impaired finance receivables are no longer considered