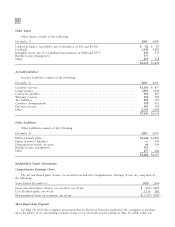

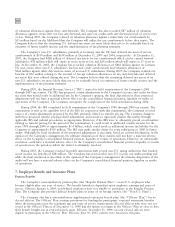

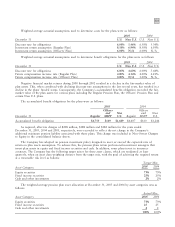

Motorola 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

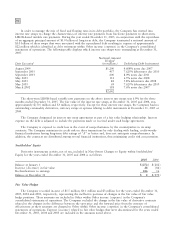

market conditions. During the year ended December 31, 2005, the Company paid $874 million to repurchase

41.7 million shares pursuant to the program. All repurchased shares have been retired.

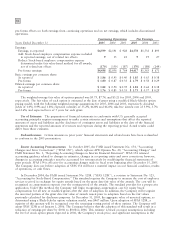

4. Debt and Credit Facilities

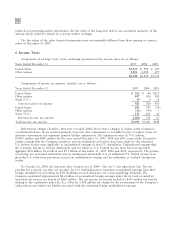

Long-Term Debt

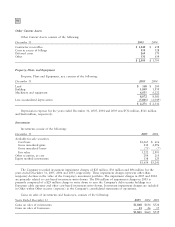

December 31

2005

2004

7.6% notes due 2007 $ 118 $ 118

4.608% senior notes due 2007 1,212 1,219

6.5% notes due 2008 114 200

5.8% notes due 2008 84 324

7.625% notes due 2010 525 1,193

8.0% notes due 2011 599 598

6.5% debentures due 2025 397 398

7.5% debentures due 2025 398 398

6.5% debentures due 2028 296 295

5.22% debentures due 2097 193 193

Other long-term debt 39 42

3,975 4,978

Fair value adjustment (50) 3

Less: current maturities (119) (400)

Long-term debt $3,806 $4,581

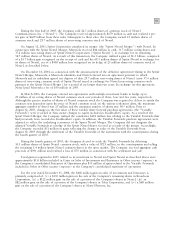

Short-Term Debt

December 31

2005

2004

Notes to banks $29 $17

Commercial paper 300 300

329 317

Add: current maturities 119 400

Notes payable and current portion of long-term debt $448 $717

Weighted average interest rates on short-term borrowings

Commercial paper 3.4% 1.6%

Other short-term debt 3.4% 3.3%

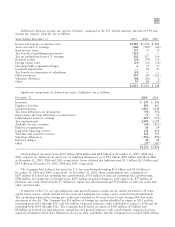

In August 2005, the Company commenced cash tender offers for up to $1.0 billion of certain of its

outstanding long-term debt. The tender offers expired on September 28, 2005 and the Company repurchased an

aggregate principal amount of $1.0 billion of its outstanding long-term debt for an aggregate purchase price of

$1.1 billion. Included in the $1.0 billion of long-term debt repurchased were repurchases of a principal amount of:

(i) $86 million of the $200 million of 6.50% Notes due 2008 outstanding, (ii) $241 million of the $325 million of

5.80% Notes due 2008 outstanding, and (iii) $673 million of the $1.2 billion of 7.625% Notes due 2010

outstanding. In addition, the Company terminated a notional amount of $1.0 billion of fixed-to-floating interest

rate swaps associated with the debt repurchased, resulting in an expense of approximately $22 million. The

aggregate charge for the repurchase of the debt and the termination of the associated interest rate swaps, as

presented in Other income (expense) in the Company's consolidated statements of operations, was $137 million.

On September 1, 2005, the Company retired approximately $1 million of the $398 million of 6.5% Debentures

due 2025 (the ""2025 Debentures'') in connection with the holders of the debentures right to put their debentures

back to the Company. The residual put options expired unexercised and the remaining $397 million of 2025

Debentures were reclassified to long-term debt.

In August 2004, the Company completed the open market purchase of $110 million of the $409 million

aggregate principal amount outstanding of its 6.50% Debentures due 2028 (the ""2028 Debentures''). The