Motorola 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

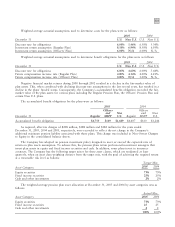

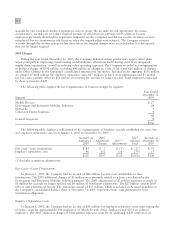

objectives measured over two-year cycles. The provision for MRIP for the years ended December 31, 2005, 2004

and 2003 was $19 million, $56 million and $5 million, respectively.

Long-Range Incentive Plan:

In 2005, a Long Range Incentive Plan (""LRIP'') was introduced to replace the

current MRIP. LRIP rewards participating elected officers for the Company's achievement of outstanding

performance during the period, based on two performance objectives measured over three-year cycles. The

provision for LRIP for the year ended December 31, 2005 was $15 million.

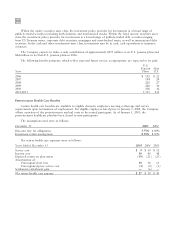

Reclassification of Incentive Compensation Costs:

The consolidated statements of operations include

reclassified incentive compensation costs, which were previously reported as a component of Selling, general and

administrative (""SG&A'') expenditures, to Cost of sales and Research and development (""R&D'') expenditures

based upon the function in which the related employees operate. The impact of this reclassification was: (i) a

reduction in Gross margin of $89 million, $143 million and $64 million in 2005, 2004 and 2003, respectively, (ii) a

decrease in SG&A expenditures of $334 million, $495 million and $244 million in 2005, 2004 and 2003,

respectively, and (iii) an increase in R&D expenditures of $245 million, $352 million and $180 million in 2005,

2004 and 2003, respectively. The reclassification has also been reflected within the quarterly financial information

provided in Note 15. The reclassifications did not affect Net sales, Operating earnings, Earnings from continuing

operations, net earnings or earnings per share.

8. Financing Arrangements

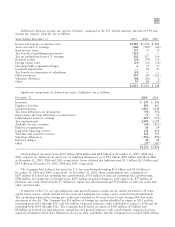

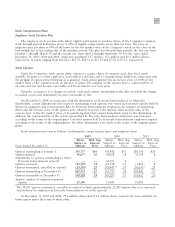

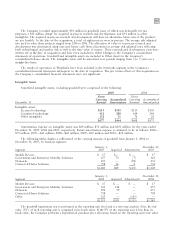

Finance receivables consist of the following:

December 31

2005

2004

Gross finance receivables $ 272 $ 2,136

Less allowance for losses (12) (1,966)

260 170

Less current portion (178) (83)

Long-term finance receivables $82$87

Current finance receivables are included in Accounts Receivable and long-term finance receivables are included

in Other Assets in the Company's consolidated balance sheets. Interest income recognized on finance receivables for

the years ended December 31, 2005, 2004 and 2003 was $7 million, $9 million and $18 million, respectively.

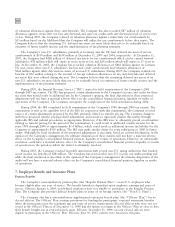

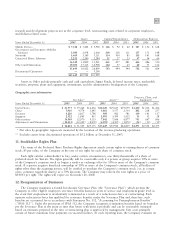

An analysis of impaired finance receivables included in total finance receivables is as follows:

December 31

2005

2004

Impaired finance receivables:

Requiring allowance for losses $10 $1,973

Expected to be fully recoverable ÌÌ

10 1,973

Less allowance for losses on impaired finance receivables 10 1,966

Impaired finance receivables, net $Ì $7

Interest income on impaired finance receivables is recognized as cash is collected and totaled less than

$1 million for the year ended December 31, 2005 and $2 million and $5 million for the years ended December 31,

2004 and 2003, respectively.

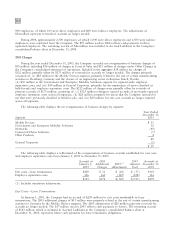

On October 28, 2005, the Company announced that it settled the Company's and its subsidiaries' financial and

legal claims against Telsim Mobil Telekomunikasyon Hizmetleri A.S. (""Telsim''). The Government of Turkey and

the Turkish Savings and Deposit Insurance Fund (""TMSF'') are third-party beneficiaries of the settlement

agreement. In settlement of its claims, the Company received $500 million in cash and the right to receive 20% of

any proceeds in excess of $2.5 billion from any sale of Telsim. On December 13, 2005, Vodafone agreed to

purchase Telsim for $4.55 billion, pursuant to a sales process organized by the TMSF. This purchase has not yet

been completed. Accordingly, Motorola expects to receive an additional cash payment of $410 million upon the

completion of the sale. The gross receivable outstanding from Telsim was zero at December 31, 2005. The

Company is permitted to, and will continue to, enforce its U.S. court judgment against the Uzan family, except in

Turkey and three other countries. As a result of difficulties in collecting the amounts due from Telsim, the