Motorola 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

$110 million principal amount of 2028 Debentures was purchased for an aggregate purchase price of approximately

$115 million.

In August 2004, pursuant to the terms of the 7.00% Equity Security Units (the ""MEUs''), the $1.2 billion of

6.50% Senior Notes due 2007 (the ""2007 MEU Notes'') that comprised a portion of the MEUs were remarketed

to a new set of holders. In connection with the remarketing, the interest rate on the 2007 MEU Notes was reset to

4.608%. None of the other terms of the 2007 MEU Notes were changed. Shortly after the remarketing, the

Company entered into interest rate swaps to change the characteristics of the interest rate payments from fixed-rate

payments to short-term LIBOR-based variable rate payments. Additionally, in November 2004, pursuant to the

terms of the MEUs, the Company sold 69.4 million shares of common stock to the holders of the MEUs. The

purchase price per share was $17.30 resulting in aggregate proceeds of $1.2 billion.

In July 2004, the Company commenced a cash tender offer for any and all of the $300 million aggregate

principal amount outstanding of its 7.60% Notes due 2007 (the ""2007 Notes''). The tender offer expired in August

2004 and an aggregate principal amount of approximately $182 million of 2007 Notes was validly tendered. In

August 2004, the Company repurchased the validly tendered 2007 Notes for an aggregate purchase price of

approximately $202 million. This debt was repurchased with proceeds distributed to the Company by Freescale

Semiconductor.

In July 2004, the Company called for the redemption of the $1.4 billion aggregate principal amount

outstanding of its 6.75% Notes due 2006 (the ""2006 Notes''). All of the 2006 Notes were redeemed in August

2004 for an aggregate purchase price of approximately $1.5 billion. This debt was redeemed partially with proceeds

distributed to the Company by Freescale Semiconductor and partially with available cash balances.

In June 2004, the Company repaid, at maturity, all $500 million aggregate principal amount outstanding of its

6.75% Debentures due 2004.

In March 2004, Motorola Capital Trust I, a Delaware statutory business trust and wholly-owned subsidiary of

the Company (the ""Trust''), redeemed all outstanding Trust Originated Preferred Securities

SM

(""TOPrS''). In

February 1999, the Trust sold 20 million TOPrS to the public for an aggregate offering price of $500 million. The

Trust used the proceeds from that sale, together with the proceeds from its sale of common stock to the Company,

to buy a series of 6.68% Deferrable Interest Junior Subordinated Debentures due March 31, 2039 (the

""Subordinated Debentures'') from the Company with the same payment terms as the TOPrS. The sole assets of the

Trust were the Subordinated Debentures. Historically, the TOPrS have been reflected as ""Company-Obligated

Mandatorily Redeemable Preferred Securities of Subsidiary Trust Holding Solely Company-Guaranteed Debentures''

in the Company's consolidated balance sheets. On March 26, 2004, all outstanding TOPrS were redeemed for an

aggregate redemption price of $500 million plus accrued interest. No TOPrS or Subordinated Debentures remain

outstanding.

In March 2004, the Company also redeemed all outstanding Liquid Yield Option Notes due September 7, 2009

(the ""2009 LYONs'') and all outstanding Liquid Yield Option Notes due September 27, 2013 (the ""2013

LYONs''). On March 26, 2004, all then-outstanding 2009 LYONs and 2013 LYONs, not validly exchanged for

stock, were redeemed for an aggregate redemption price of approximately $4 million. No 2009 LYONs or 2013

LYONs remain outstanding.

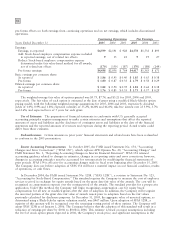

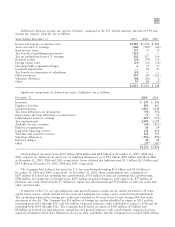

Aggregate requirements for long-term debt maturities (assuming earliest put date) during the next five years are

as follows: 2006-$119 million; 2007-$1.2 billion; 2008-$200 million; 2009-$2 million.; 2010-$529 million

In May 2004, the Company signed a new 3-year revolving credit agreement for $1 billion, replacing two

existing facilities totaling $1.6 billion. At December 31, 2005, the commitment fee assessed against the daily average

amounts unused was 12.5 basis points. Important terms of the credit agreement include covenants relating to net

interest coverage and total debt to book capitalization ratios. The Company was in compliance with the terms of

the credit agreement at December 31, 2005. The Company's current corporate credit ratings are ""BBB°'' with a

""stable'' outlook by S&P, ""Baa2'' with a ""stable'' outlook by Moody's, and ""BBB°'' with a ""positive'' outlook by

Fitch. The Company has never borrowed under its domestic revolving credit facilities. The Company also has

$1.9 billion of non-U.S. credit facilities with interest rates on borrowings varying from country to country

depending upon local market conditions. At December 31, 2005, the Company's total domestic and non-U.S. credit

facilities totaled $2.9 billion, of which $95 million was considered utilized.

LYONs is a trademark of Merrill Lynch & Co., Inc.

SM ""Trust Originated Preferred Securities'' and ""TOPrS'' are service marks of Merrill Lynch & Co., Inc.