Motorola 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

Company had previously recorded charges reducing the net receivable from Telsim to zero. The net receivable from

Telsim has been zero since 2002.

From time to time, the Company sells short-term receivables, long-term loans and lease receivables under sales-

type leases (collectively, ""finance receivables'') to third parties in transactions that qualify as ""true-sales.'' Certain

of these finance receivables are sold to third parties on a one-time, non-recourse basis, while others are sold to

third parties under committed facilities that involve contractual commitments from these parties to purchase

qualifying receivables up to an outstanding monetary limit. Committed facilities may be revolving in nature. Certain

sales may be made through separate legal entities that are also consolidated by the Company. The Company may or

may not retain the obligation to service the sold finance receivables.

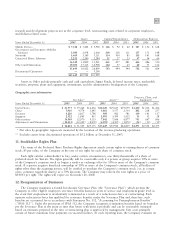

In the aggregate, at December 31, 2005, these committed facilities provided for up to $1.1 billion to be

outstanding with the third parties at any time, as compared to up to $724 million provided at December 31, 2004

and up to $598 million provided at December 31, 2003. As of December 31, 2005, $585 million of these

committed facilities were utilized, compared to $305 million utilized at December 31, 2004 and $295 million

utilized at December 31, 2003. Certain events could cause one of these facilities to terminate. In addition, before

receivables can be sold under certain of the committed facilities they may need to meet contractual requirements,

such as credit quality or insurability.

Total finance receivables sold by the Company were $4.5 billion in 2005 (including $4.2 billion of short-term

receivables), compared to $3.8 billion sold in 2004 (including $3.8 billion of short-term receivables) and

$2.8 billion sold in 2003 (including $2.7 billion of short-term receivables). As of December 31, 2005, there were

$1.0 billion of receivables outstanding under these programs for which the Company retained servicing obligations

(including $838 million of short-term receivables), compared to $720 million outstanding at December 31, 2004

(including $589 of short-term receivables) and $557 million outstanding at December 31, 2003 (including $378 of

short-term receivables).

Under certain of the receivables programs, the value of the receivables sold is covered by credit insurance

obtained from independent insurance companies, less deductibles or self-insurance requirements under the policies

(with the Company retaining credit exposure for the remaining portion). The Company's total credit exposure to

outstanding short-term receivables that have been sold was $66 million at December 31, 2005 as compared to

$25 million at December 31, 2004. Reserves of $4 million were recorded for potential losses on sold receivables at

both December 31, 2005 and December 31, 2004.

Certain purchasers of the Company's infrastructure equipment continue to request that suppliers provide

financing in connection with equipment purchases. These requests may include all or a portion of the purchase

price of the equipment as well as working capital. Periodically, the Company makes commitments to provide

financing to purchasers in connection with the sale of equipment. However, the Company's obligation to provide

financing is often conditioned on the issuance of a letter of credit in favor of the Company by a reputable bank to

support the purchaser's credit or a pre-existing commitment from a reputable bank to purchase the receivable from

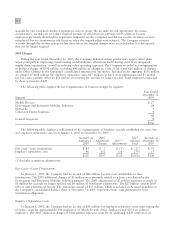

the Company. The Company had outstanding commitments to extend credit to third-parties totaling $689 million at

December 31, 2005, compared to $294 million at December 31, 2004. Of these amounts, $594 million was

supported by letters of credit or by bank commitments to purchase receivables at December 31, 2005, compared to

$162 million at December 31, 2004.

In addition to providing direct financing to certain equipment customers, the Company also assists customers in

obtaining financing directly from banks and other sources to fund equipment purchases. The Company had

committed to provide financial guarantees relating to customer financing totaling $115 million and $78 million at

December 31, 2005 and December 31, 2004, respectively (including $66 million and $70 million, respectively,

relating to the sale of short-term receivables). Customer financing guarantees outstanding were $71 million and

$29 million at December 31, 2005 and December 31, 2004, respectively (including $42 million and $25 million,

respectively, relating to the sale of short-term receivables).

9. Commitments and Contingencies

Leases

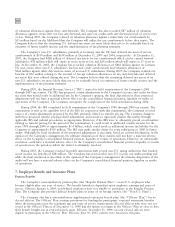

The Company owns most of its major facilities, but does lease certain office, factory and warehouse space,

land, and information technology and other equipment under principally non-cancelable operating leases. Rental

expense, net of sublease income for the years ended December 31, 2005, 2004 and 2003 was $254 million,