Motorola 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

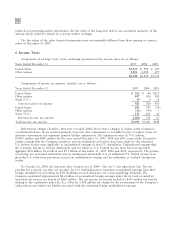

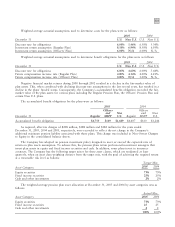

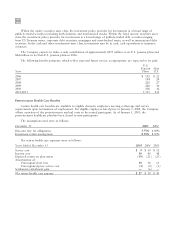

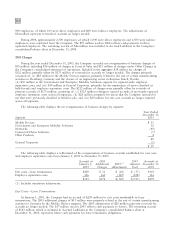

The following table summarizes information about stock options outstanding and exercisable at December 31,

2005 (in thousands, except exercise price and years):

Options Outstanding Options Exercisable

Wtd. avg. Wtd. avg. Wtd. avg.

No. of exercise contractual No. of exercise

Exercise price range options price life (in yrs.) options price

Under $7 821 $ 6 3 790 $ 6

$7-$13 109,899 10 6 71,123 11

$14-$20 122,273 16 7 43,511 17

$21-$27 2,555 24 5 1,698 25

$28-$34 1,882 32 4 1,882 32

$35-$41 29,910 39 9 29,910 39

$42-$48 379 47 5 379 44

$49-$55 36 51 4 36 51

267,755 149,329

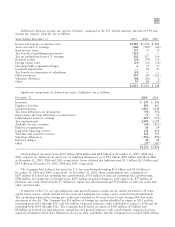

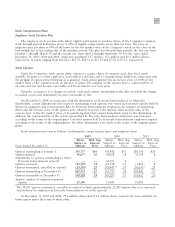

Restricted Stock and Restricted Stock Unit Grants

Restricted stock and restricted stock unit grants (""restricted stock'') consist of shares or the rights to shares of

the Company's common stock which are awarded to employees. The grants are restricted such that they are subject

to substantial risk of forfeiture and to restrictions on their sale or other transfer by the employee. Upon the

occurrence of a change in control, the restrictions on all shares of restricted stock and restricted stock units

outstanding on the date on which the change in control occurs will lapse.

Total restricted stock and restricted stock units issued and outstanding at December 31, 2005 and 2004 were

4.4 million and 6.0 million, respectively. At December 31, 2005 and 2004, the amount of related deferred

compensation reflected in Stockholders' Equity in the Company's consolidated balance sheets was $37 million and

$36 million, respectively. Net additions to deferred compensation for both the years ended December 31, 2005 and

2004 were $15 million and $10 million, respectively. An aggregate of approximately 1.7 million, 1.1 million, and

2.5 million shares of restricted stock and restricted stock units were granted in 2005, 2004 and 2003, respectively.

The amortization of deferred compensation for the years ended December 31, 2005, 2004 and 2003 was

$14 million, $24 million and $36 million, respectively.

Other Benefits

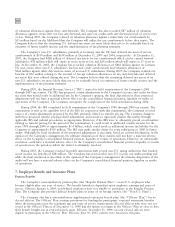

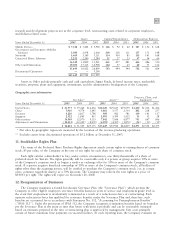

Defined Contribution Plans:

The Company and certain subsidiaries have various defined contribution plans,

in which all eligible employees participate.

In the U.S., the 401(k) plan is a contributory plan. Matching contributions are based upon the amount of the

employees' contributions. Effective January 1, 2005, newly hired employees have a higher maximum matching

contribution at 4% on the first 6% of employee contributions, compared to 3% for employees hired prior to

January 2005.

Company contributions, primarily relating to the employer match, to all plans for the years ended

December 31, 2005, 2004 and 2003 were $81 million, $74 million and $67 million, respectively. Effective January 1,

2005, the plan was amended to exclude the profit sharing component. The profit sharing contribution for the year

ended December 31, 2004 was $69 million. There was no profit sharing contribution for the year ended

December 31, 2003. Before 2005, profit sharing contributions were generally based upon pre-tax earnings, as

defined, with an adjustment for the aggregate matching contribution.

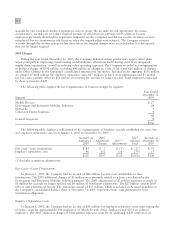

Motorola Incentive Plan:

The Motorola Incentive Plan provides eligible employees with an annual payment,

calculated as a percentage of an employee's eligible earnings, in the year after the close of the current calendar year

if specified business goals are met. The provision for awards under these incentive plans for the years ended

December 31, 2005, 2004 and 2003 were $548 million, $771 million and $422 million, respectively.

Mid-Range Incentive Plan:

The Mid-Range Incentive Plan (""MRIP'') rewards participating elected officers

for the Company's achievement of outstanding performance during the period, based on two performance