Motorola 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

required in interpreting market information, the fair value of the long-term debt is not necessarily indicative of the

amount which could be realized in a current market exchange.

The fair values of the other financial instruments were not materially different from their carrying or contract

values at December 31, 2005.

6. Income Taxes

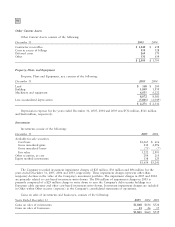

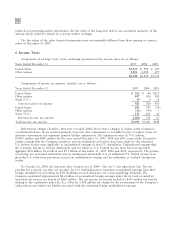

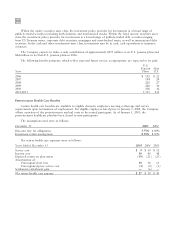

Components of earnings (loss) from continuing operations before income taxes are as follows:

Years Ended December 31 2005 2004 2003

United States $3,319 $ 994 $ 679

Other nations 3,201 2,258 697

$6,520 $3,252 $1,376

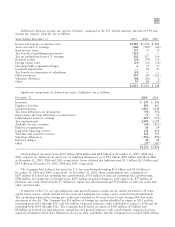

Components of income tax expense (benefit) are as follows:

Years Ended December 31 2005 2004 2003

United States $ 265 $ 44 $115

Other nations 637 456 300

States (U.S.) 19 616

Current income tax expense 921 506 431

United States 891 547 (14)

Other nations (42) (94) Ì

States (U.S.) 151 102 31

Deferred income tax expense 1,000 555 17

Total income tax expense $1,921 $1,061 $448

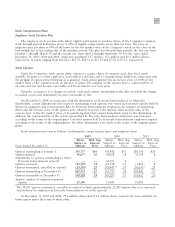

Deferred tax charges (benefits) that were recorded within Non-Owner Changes to Equity in the Company's

consolidated balance sheets resulted primarily from fair value adjustments to available-for-sale securities, losses on

derivative instruments and minimum pension liability adjustments. The adjustments were $(753) million,

$(189) million and $440 million for the years ended December 31, 2005, 2004 and 2003, respectively. Except for

certain earnings that the Company intends to reinvest indefinitely, provisions have been made for the estimated

U.S. federal income taxes applicable to undistributed earnings of non-U.S. subsidiaries. Undistributed earnings that

the Company intends to reinvest indefinitely, and for which no U.S. Federal income taxes has been provided,

aggregate $2.8 billion, $5.6 billion and $5.1 billion at December 31, 2005, 2004 and 2003, respectively. The portion

of earnings not reinvested indefinitely may be distributed substantially free of additional U.S. federal income taxes

given the U.S. federal tax provisions accrued on undistributed earnings and the utilization of available foreign tax

credits.

On October 22, 2004, the American Jobs Creation Act of 2004 (""the Act'') was signed into law. The Act

provides for a special one-time tax incentive for U.S. multinationals to repatriate accumulated earnings from their

foreign subsidiaries by providing an 85% dividends received deduction for certain qualifying dividends. The

Company repatriated approximately $4.6 billion of accumulated foreign earnings under the Act and recorded an

associated net income tax benefit of $265 million. The net income tax benefit included a $303 million tax benefit

relating to the repatriation under the Act, offset by a $38 million tax charge for the reassessment of the Company's

cash position and related tax liability associated with the remaining foreign undistributed earnings.