Motorola 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

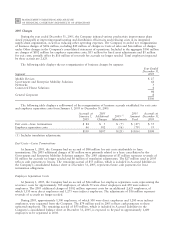

development, and (ii) Government and Enterprise Mobility Solutions driven by increased investment in new

technologies.

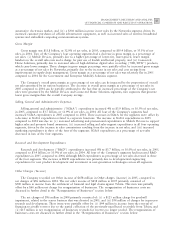

Other Charges (Income)

The Company recorded net charges of $96 million in Other charges (income) in 2004, compared to net other

income of $34 million in 2003. The net charges of $96 million in 2004 primarily consisted of: (i) a $125 million

charge for goodwill impairment, related to the sensor business that was divested in 2005, and (ii) $34 million of

charges for IPR&D related to the acquisitions of MeshNetworks, Inc., CRISNET, Inc., Quantum Bridge and Force

Computers. These items were partially offset by: (i) $44 million in income from the reversal of financing receivable

reserves due to the partial collection of the previously-uncollected receivable from Telsim, and (ii) $15 million in

net reorganization of businesses reversals for reserves no longer needed. The reorganization of businesses costs are

discussed in further detail in the ""Reorganization of Businesses'' section below.

The net other income of $34 million in 2003 primarily consisted of: (i) $69 million in income from the

reversal of accruals no longer needed due to a settlement with the Company's insurer on items related to previous

environmental claims, (ii) $59 million in income due to the reassessment of remaining reserve requirements as a

result of a litigation settlement agreement with The Chase Manhattan Bank regarding Iridium, and (iii) $41 million

in income from the sale of Iridium-related assets that were previously written down. These items were partially

offset by: (i) a $73 million impairment charge relating to goodwill, (ii) $32 million of IPR&D charges, and (iii) a

$23 million net charge for reorganization of businesses. The reorganization of businesses costs are discussed in

further detail in the ""Reorganization of Businesses'' section below.

Net Interest Expense

Net interest expense was $199 million in 2004, compared to $294 million in 2003. Net interest expense in

2004 included interest expense of $353 million, partially offset by interest income of $154 million. Net interest

expense in 2003 included interest expense of $423 million, partially offset by interest income of $129 million. The

decrease in net interest expense in 2004 compared to 2003 reflects: (i) a reduction in total debt during 2004,

(ii) benefits derived from fixed-to-floating interest rate swaps, and (iii) an increase in interest income due to higher

average cash, cash equivalents and Sigma Funds balances.

Gains on Sales of Investments and Businesses

Gains on sales of investments and businesses were $460 million in 2004, compared to $539 million in 2003.

The 2004 net gains were primarily: (i) a $130 million gain on the sale of the Company's remaining shares in

Broadcom Corporation, (ii) a $122 million gain on the sale of a portion of the Company's shares in Nextel,

(iii) an $82 million gain on the sale of a portion of the Company's shares in Telus Corporation, and (iv) a

$68 million gain on the sale of a portion of the Company's shares in Nextel Partners.

The 2003 net gains were primarily: (i) a $255 million gain on the sale of a portion of the Company's shares in

Nextel, (ii) an $80 million gain on the sale of the Company's shares in Symbian Limited, (iii) a $65 million gain

on the sale of the Company's shares in UAB Omnitel of Lithuania, and (iv) a $61 million gain on the sale of a

portion of the Company's shares in Nextel Partners.

Other

Charges classified as Other, as presented in Other income (expense), were $141 million in 2004, compared to

$142 million in 2003. The $141 million of charges in 2004 primarily were: (i) charges of $81 million for costs

related to the redemption of debt, (ii) foreign currency losses of $44 million, and (iii) $36 million of investment

impairment charges.

The $142 million of charges in 2003 primarily related to: (i) $96 million of investment impairment charges,

and (ii) foreign currency losses of $73 million.