Motorola 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

impaired and are reclassified to performing when they have performed under a work out or restructuring for four

consecutive quarters.

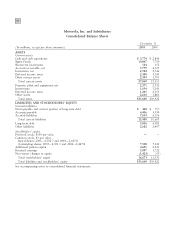

Fair Values of Financial Instruments: The fair values of financial instruments are determined based on quoted

market prices and market interest rates as of the end of the reporting period. The Company's financial instruments

include cash and cash equivalents, Sigma Funds, short-term investments, accounts receivable, long-term finance

receivables, accounts payable, accrued liabilities, notes payable, long-term debt, foreign currency contracts and other

financing commitments. The fair values of these financial instruments were, with the exception of long-term debt as

disclosed in Note 4, not materially different from their carrying or contract values at December 31, 2005 and 2004.

Foreign Currency Translation: Many of the Company's non-U.S. operations use the respective local currency

as the functional currency. These operations that do not have the U.S. dollar as their functional currency translate

assets and liabilities at current rates of exchange in effect at the balance sheet date and revenues and expenses using

the monthly average exchange rates in effect for the period in which the items occur. The resulting translation

increases and decreases are included as a component of Stockholders' Equity in the Company's consolidated

balance sheet. For those operations that have the U.S. dollar as their functional currency, transactions denominated

in the local currency are measured into U.S. dollars using the current rates of exchange for monetary assets and

liabilities and historical rates of exchange for nonmonetary assets. Gains and losses from remeasurement of

monetary assets and liabilities are included in Other income (expense) within the Company's consolidated

statement of operations.

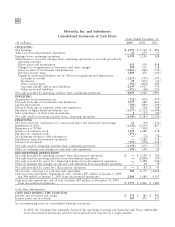

Foreign Currency Transactions: The effects of remeasuring the non-functional currency assets or liabilities

into the functional currency, as well as gains and losses on hedges of existing assets, or liabilities are marked-to-

market and the result is included within Other income (expense) in the consolidated statements of operations.

Gains and losses on financial instruments that hedge firm future commitments are deferred until such time as the

underlying transactions are recognized or recorded immediately when the transaction is no longer expected to

occur. Gains or losses on financial instruments that do not qualify as hedges under Statement of Financial

Accounting Standards (""SFAS'') No. 133, ""Accounting for Derivative Instruments and Hedging Activities,'' are

recognized immediately as income or expense.

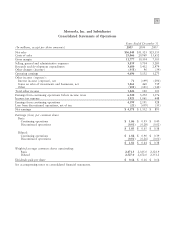

Earnings Per Share: The Company calculates its basic earnings per share based on the weighted effect of all

common shares issued and outstanding. Net income is divided by the weighted average common shares outstanding

during the period to arrive at the basic earnings per share. Diluted earnings per share is calculated by dividing net

income by the sum of the weighted average number of common shares used in the basic earnings per share

calculation and the weighted average number of common shares that would be issued assuming exercise or

conversion of all potentially dilutive securities, excluding those securities that would be anti-dilutive to the earnings

per share calculation. Both basic and diluted earnings per share amounts are calculated for earnings from continuing

operations and loss from discontinued operations for all periods presented.

Stock Compensation Costs: The Company measures compensation cost for stock options and restricted stock

using the intrinsic value-based method. Compensation cost, if any, is recorded based on the excess of the quoted

market price at grant date over the amount an employee must pay to acquire the stock. The Company has

evaluated the pro forma effects of using the fair value-based method of accounting and has presented below the