Motorola 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

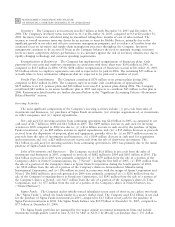

shares of non-voting common stock of Sprint Nextel issued in exchange for Nextel non-voting common stock

pursuant to the Sprint Nextel Merger) for a period of no longer than two years. In exchange for this agreement,

Nextel paid Motorola a fee of $50 million in the third quarter 2005.

In March 2003, the Company entered into agreements with multiple investment banks to hedge up to

25 million of its voting shares of Nextel common stock over periods of three, four and five years, respectively.

Although the precise number of shares of Nextel common stock the Company was required to deliver to satisfy the

contracts was dependent upon the price of Nextel common stock on the various settlement dates, the maximum

aggregate number of shares was 25 million and the minimum number of shares was 18.5 million. Prior to

August 12, 2005, changes in the fair value of these variable share forward purchase agreements (the ""Variable

Forwards'') were recorded in Non-owner changes to equity included in Stockholders equity. As a result of the

Sprint Nextel Merger, the Company realized the cumulative $418 million loss relating to the Variable Forwards that

had previously been recorded in Stockholder's equity. In addition, the Variable Forwards were adjusted to reflect

the underlying economics of the Sprint Nextel Merger. The Company did not designate the adjusted Variable

Forwards as a hedge of the Sprint Nextel shares received as a result of the merger. Accordingly, the Company

recorded $51 million of gains reflecting the change in value of the Variable Forwards from August 12, 2005

through the settlement of the Variable Forwards with the counterparties during the fourth quarter of 2005.

During the fourth quarter of 2005, the Company elected to settle the Variable Forwards by delivering

30.3 million shares of Sprint Nextel common stock, with a value of $725 million, to the counterparties and selling

the remaining 1.4 million Sprint Nextel common shares in the open market. The Company received aggregate cash

proceeds of $391 million and realized a loss of $70 million in connection with the settlement and sale.

Total gains recognized in 2005 related to its investment in Nextel and Sprint Nextel as described above were

approximately $1.8 billion included in Gains on sales of investments and businesses in Other income (expense) in

the Company's consolidated statement of operations plus $51 million of gains related to the Variable Forwards

included in Other in Other income (expense) in the Company's consolidated statement of operations.

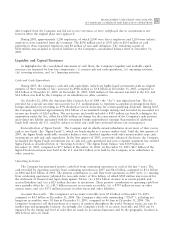

Financing Activities

The most significant components of the Company's financing activities are: (i) net proceeds from (or

repayment of) commercial paper and short-term borrowings, (ii) net proceeds from (or repayment of) long-term

debt securities, (iii) the payment of dividends, (iv) proceeds from the issuances of stock due to the exercise of

employee stock options and purchases under the employee stock purchase plan, and (v) the purchase of the

Company's common stock under its share repurchase program.

Net cash used for financing activities was $1.2 billion in 2005, compared to $237 million of cash used in 2004

and $757 million of cash used in 2003. Cash used for financing activities in 2005 was primarily: (i) $1.1 billion of

cash used to repay debt, (ii) $874 million of cash used for the purchase of the Company's common stock under

the share repurchase program, and (iii) $394 million of cash used to pay dividends, partially offset by proceeds of

$1.2 billion received from the issuance of common stock in connection with the Company's employee stock option

plans and employee stock purchase plan.

Cash used for financing activities in 2004 was primarily attributable to: (i) $2.3 billion to repay debt

(including commercial paper), (ii) $500 million to redeem all outstanding Trust Originated Preferred Securities

SM

(the ""TOPrS''), and (iii) $378 million to pay dividends, partially offset by: (i) $1.7 billion in proceeds received

from the issuance of common stock in connection with the Company's employee stock option plans and employee

stock purchase plan, and (ii) $1.3 billion in distributions from discontinued operations.

Short-term Debt: At December 31, 2005, the Company's outstanding notes payable and current portion of

long-term debt was $448 million, compared to $717 million at December 31, 2004. In the fourth quarter of 2004,

$398 million of 6.5% Debentures due 2025 (the ""2025 Debentures'') were reclassified to current maturities of long-

term debt, as the holders of the debentures had the right to put their debentures back to the Company on

September 1, 2005. $1 million of the 2025 Debentures were submitted for redemption on September 1, with the

remaining put options expiring unexercised. The remaining $397 million of 2025 Debentures were reclassified back

to long-term debt in the third quarter of 2005. In addition, the remaining $118 million of 7.6% Notes due

January 1, 2007 (the ""2007 Notes'') were reclassified to current maturities of long-term debt.