Microsoft 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

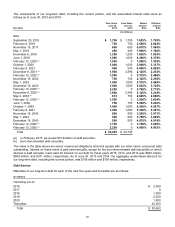

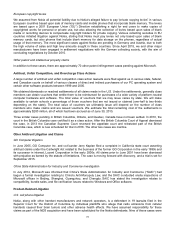

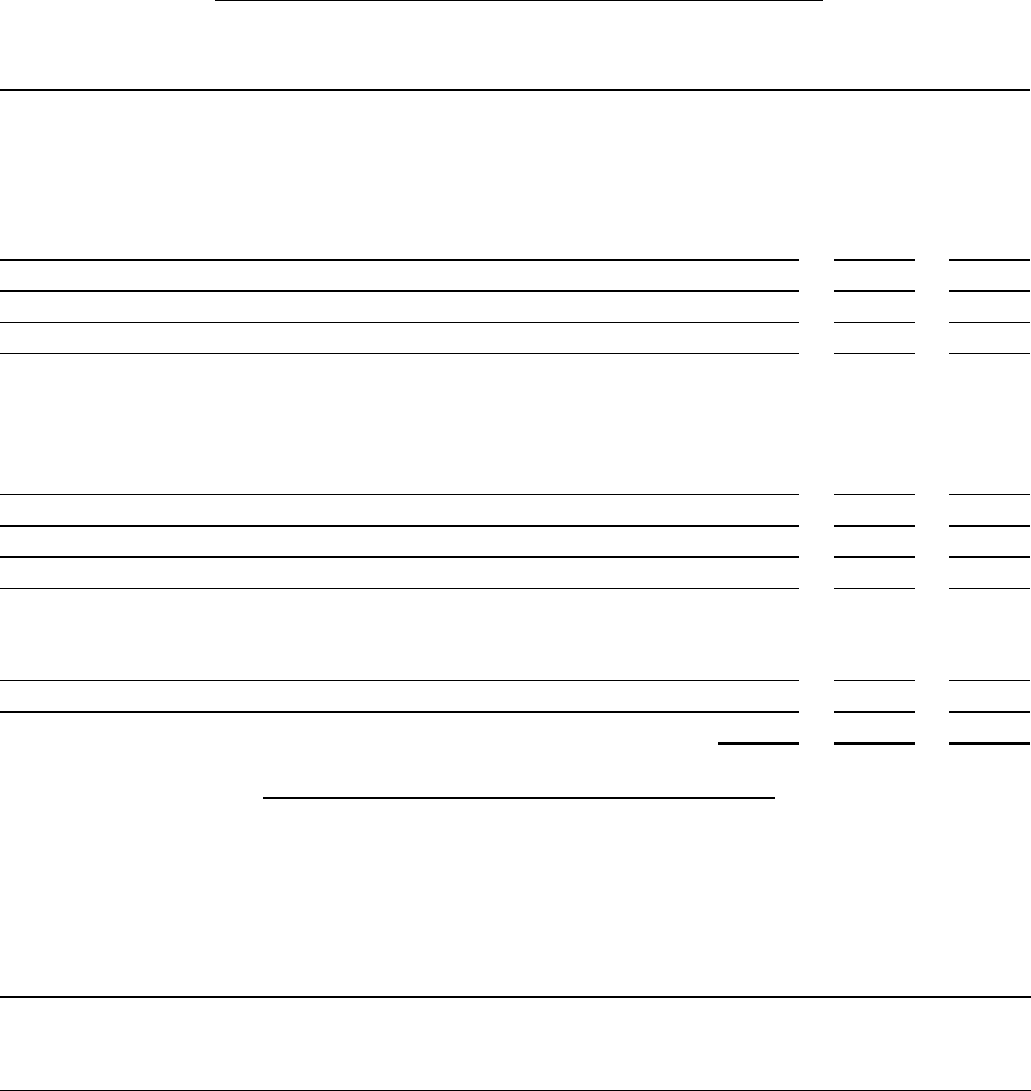

NOTE 20 — ACCUMULATED OTHER COMPREHENSIVE INCOME

The following table summarizes the changes in accumulated other comprehensive income by component:

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Derivatives

Accumulated other comprehensive income balance, beginning of period $31 $ 66 $92

Unrealized gains, net of tax effects of $35, $2 and $54 1,152 63 101

Reclassification adjustments for gains included in revenue (608 ) (104) (195)

Tax expense included in provision for income taxes 15 6 68

Amounts reclassified from accumulated other comprehensive income (593 ) (98) (127)

Net current period other comprehensive income (loss) 559 (35) (26)

Accumulated other comprehensive income balance, end of period $590 $ 31 $66

Investments

Accumulated other comprehensive income balance, beginning of period $3,531 $ 1,794 $1,431

Unrealized gains, net of tax effects of $59, $1,067 and $244 110 2,053 453

Reclassification adjustments for gains included in other income (expense), net (728 ) (447) (139)

Tax expense included in provision for income taxes 256 131 49

Amounts reclassified from accumulated other comprehensive income (472 ) (316) (90)

Net current period other comprehensive income (loss) (362 ) 1,737 363

Accumulated other comprehensive income balance, end of period $3,169 $ 3,531 $1,794

Translation Adjustments and Other

Accumulated other comprehensive income (loss) balance, beginning of period $146 $ (117) $(101)

Translation adjustments and other, net of tax effects of $16, $12 and $(8) (1,383 ) 263 (16)

Accumulated other comprehensive income (loss) balance, end of period $(1,237 ) $ 146 $(117)

Accumulated other comprehensive income, end of period $ 2,522 $ 3,708 $ 1,743

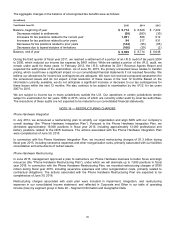

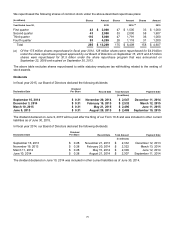

NOTE 21 — EMPLOYEE STOCK AND SAVINGS PLANS

We grant stock-based compensation to directors and employees. At June 30, 2015, an aggregate of 294 million

shares were authorized for future grant under our stock plans. Awards that expire or are canceled without delivery of

shares generally become available for issuance under the plans. We issue new shares of Microsoft common stock to

satisfy exercises and vesting of awards granted under all of our stock plans.

Stock-based compensation expense and related income tax benefits were as follows:

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Stock-based compensation expense $ 2,574 $ 2,446 $ 2,406

Income tax benefits related to stock-based compensation $868 $ 830 $842

Stock Plans

Stock awards

Stock awards (“SAs”) are grants that entitle the holder to shares of Microsoft common stock as the award vests. SAs

generally vest over a four or five-year period.

Executive incentive plan

Under the Executive Incentive Plan, the Compensation Committee awards SAs to executive officers and certain

senior executives. The SAs vest ratably in August of each of the four years following the grant date.