Microsoft 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

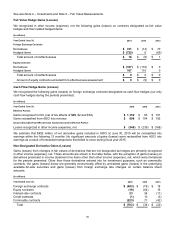

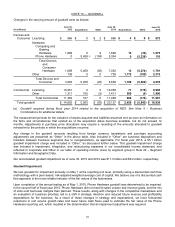

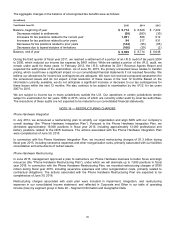

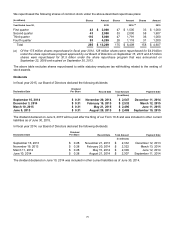

The components of the deferred income tax assets and liabilities were as follows:

(In millions)

June 30, 2015 2014

Deferred Income Tax Assets

Stock-based compensation expense $ 884 $903

Other expense items 1,531 1,112

Restructuring charges 211 0

Unearned revenue 520 520

Impaired investments 257 272

Loss carryforwards 1,158 922

Depreciation and amortization 798 0

Other revenue items 56 64

Deferred income tax assets 5,415 3,793

Less valuation allowance (2,265) (903)

Deferred income tax assets, net of valuation allowance $ 3,150 $ 2,890

Deferred Income Tax Liabilities

Foreign earnings $ (1,280)$(1,140)

Unrealized gain on investments and debt (2,223) (1,974)

Depreciation and amortization (685) (470)

Other (29) (87)

Deferred income tax liabilities (4,217) (3,671)

Net deferred income tax assets (liabilities) $ (1,067)$(781)

Reported As

Current deferred income tax assets $ 1,915 $1,941

Other current liabilities (211) (125)

Other long-term assets 64 131

Long-term deferred income tax liabilities (2,835) (2,728)

Net deferred income tax assets (liabilities) $ (1,067)$(781)

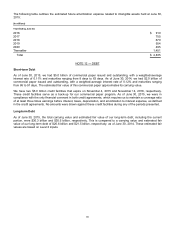

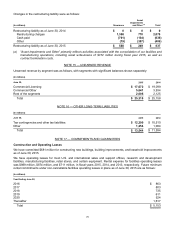

As of June 30, 2015, we had net operating loss carryforwards of $4.6 billion, including $1.8 billion of foreign net

operating loss carryforwards acquired through our acquisition of Skype, and $545 million through our acquisition of

NDS. The valuation allowance disclosed in the table above relates to the foreign net operating loss carryforwards

and other future deductible net deferred tax assets that may not be realized.

Deferred income tax balances reflect the effects of temporary differences between the carrying amounts of assets

and liabilities and their tax bases and are stated at enacted tax rates expected to be in effect when the taxes are

actually paid or recovered.

As of June 30, 2015, we have not provided deferred U.S. income taxes or foreign withholding taxes on temporary

differences of approximately $108.3 billion resulting from earnings for certain non-U.S. subsidiaries which are

permanently reinvested outside the U.S. The unrecognized deferred tax liability associated with these temporary

differences was approximately $34.5 billion at June 30, 2015.

Income taxes paid were $4.4 billion, $5.5 billion, and $3.9 billion in fiscal years 2015, 2014, and 2013, respectively.

Uncertain Tax Positions

Unrecognized tax benefits as of June 30, 2015, 2014, and 2013, were $9.6 billion, $8.7 billion, and $8.6 billion,

respectively. If recognized, these tax benefits would affect our effective tax rates for fiscal years 2015, 2014, and

2013, by $7.9 billion, $7.0 billion, and $6.5 billion, respectively.

As of June 30, 2015, 2014, and 2013, we had accrued interest expense related to uncertain tax positions of $1.7

billion, $1.5 billion, and $1.3 billion, respectively, net of federal income tax benefits. Interest expense on

unrecognized tax benefits was $237 million, $235 million, and $400 million in fiscal years 2015, 2014, and 2013,

respectively, and was included in income tax expense.