Microsoft 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

likely than not that we will be required to sell the security before recovery. We also consider specific adverse

conditions related to the financial health of and business outlook for the investee, including industry and sector

performance, changes in technology, and operational and financing cash flow factors. Once a decline in fair value is

determined to be other-than-temporary, an impairment charge is recorded to other income (expense), net and a new

cost basis in the investment is established.

Derivative instruments are recognized as either assets or liabilities and are measured at fair value. The accounting

for changes in the fair value of a derivative depends on the intended use of the derivative and the resulting

designation.

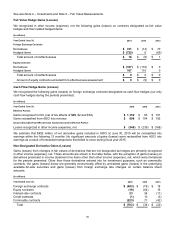

For derivative instruments designated as fair value hedges, the gains (losses) are recognized in earnings in the

periods of change together with the offsetting losses (gains) on the hedged items attributed to the risk being hedged.

For options designated as fair value hedges, changes in the time value are excluded from the assessment of hedge

effectiveness and are recognized in earnings.

For derivative instruments designated as cash-flow hedges, the effective portion of the gains (losses) on the

derivatives is initially reported as a component of OCI and is subsequently recognized in earnings when the hedged

exposure is recognized in earnings. For options designated as cash-flow hedges, changes in the time value are

excluded from the assessment of hedge effectiveness and are recognized in earnings. Gains (losses) on derivatives

representing either hedge components excluded from the assessment of effectiveness or hedge ineffectiveness are

recognized in earnings.

For derivative instruments that are not designated as hedges, gains (losses) from changes in fair values are primarily

recognized in other income (expense), net. Other than those derivatives entered into for investment purposes, such

as commodity contracts, the gains (losses) are generally economically offset by unrealized gains (losses) in the

underlying available-for-sale securities, which are recorded as a component of OCI until the securities are sold or

other-than-temporarily impaired, at which time the amounts are reclassified from accumulated other comprehensive

income (“AOCI”) into other income (expense), net.

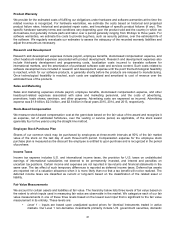

Allowance for Doubtful Accounts

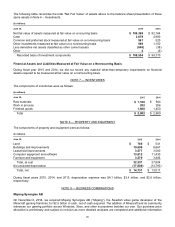

The allowance for doubtful accounts reflects our best estimate of probable losses inherent in the accounts receivable

balance. We determine the allowance based on known troubled accounts, historical experience, and other currently

available evidence. Activity in the allowance for doubtful accounts was as follows:

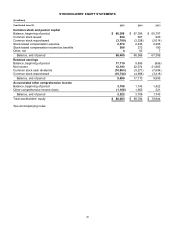

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Balance, beginning of period $ 301 $ 336 $ 389

Charged to costs and other 77 16 4

Write-offs (43 ) (51) (57)

Balance, end of period $ 335 $301 $336

Inventories

Inventories are stated at average cost, subject to the lower of cost or market. Cost includes materials, labor, and

manufacturing overhead related to the purchase and production of inventories. We regularly review inventory

quantities on hand, future purchase commitments with our suppliers, and the estimated utility of our inventory. If our

review indicates a reduction in utility below carrying value, we reduce our inventory to a new cost basis through a

charge to cost of revenue. The determination of market value and the estimated volume of demand used in the lower

of cost or market analysis require significant judgment.

Property and Equipment

Property and equipment is stated at cost and depreciated using the straight-line method over the shorter of the

estimated useful life of the asset or the lease term. The estimated useful lives of our property and equipment are

generally as follows: computer software developed or acquired for internal use, three to seven years; computer

equipment, two to three years; buildings and improvements, five to 15 years; leasehold improvements, three to 20

years; and furniture and equipment, one to 10 years. Land is not depreciated.