Microsoft 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

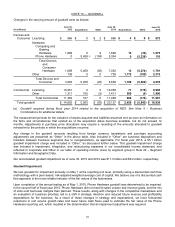

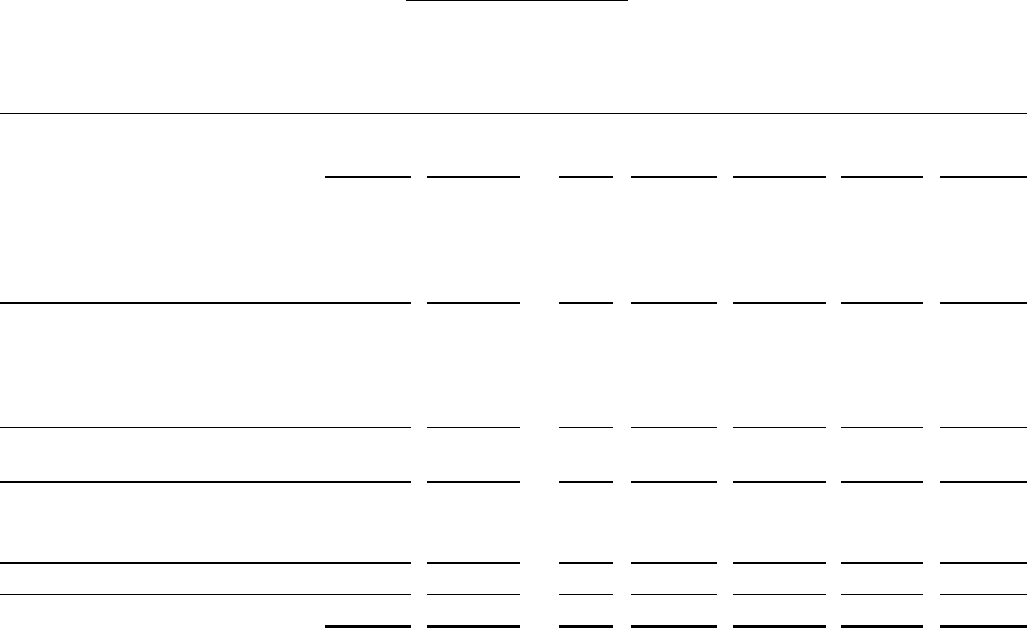

NOTE 10 — GOODWILL

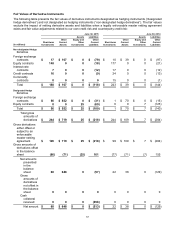

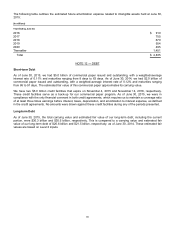

Changes in the carrying amount of goodwill were as follows:

(In millions)

June 30,

2013 Acquisitions Other

June 30,

2014 Acquisitions

Other

June 30,

2015

Devices and

Consumer Licensing $ 866 $ 0 $2 $868 $ 4 $ 0 $ 872

Hardware:

Computing and

Gaming

Hardware 1,689 0 9 1,698 13 (36) 1,675

Phone Hardware 0 5,458 (a) (104) 5,354 0 (5,238) 116

Total Devices

and

Consumer

Hardware 1,689 5,458 (95) 7,052 13 (5,274) 1,791

Other 738 0 0 738 1,772 (195) 2,315

Total Devices and

Consumer 3,293 5,458 (93) 8,658 1,789 (5,469) 4,978

Commercial Licensing 10,051 2 5 10,058 77 (170) 9,965

Other 1,311 105 (5) 1,411 589 (4) 1,996

Total Commercial 11,362 107 0 11,469 666 (174) 11,961

Total goodwill $ 14,655 $ 5,565 $ (93) $ 20,127 $ 2,455 $ (5,643) $ 16,939

(a) Goodwill acquired during fiscal year 2014 related to the acquisition of NDS. See Note 9 – Business

Combinations for additional details.

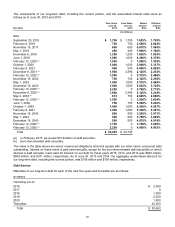

The measurement periods for the valuation of assets acquired and liabilities assumed end as soon as information on

the facts and circumstances that existed as of the acquisition dates becomes available, but do not exceed 12

months. Adjustments in purchase price allocations may require a recasting of the amounts allocated to goodwill

retroactive to the periods in which the acquisitions occurred.

Any change in the goodwill amounts resulting from foreign currency translations and purchase accounting

adjustments are presented as “Other” in the above table. Also included in “Other” are business dispositions and

transfers between business segments due to reorganizations, as applicable. For fiscal year 2015, a $5.1 billion

goodwill impairment charge was included in “Other,” as discussed further below. This goodwill impairment charge

was included in impairment, integration, and restructuring expenses in our consolidated income statement, and

reflected in Corporate and Other in our table of operating income (loss) by segment group in Note 22 – Segment

Information and Geographic Data.

Our accumulated goodwill impairment as of June 30, 2015 and 2014 was $11.3 billion and $6.2 billion, respectively.

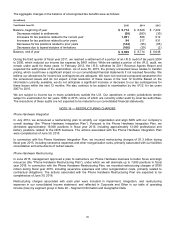

Goodwill Impairment

We test goodwill for impairment annually on May 1 at the reporting unit level, primarily using a discounted cash flow

methodology with a peer-based, risk-adjusted weighted average cost of capital. We believe use of a discounted cash

flow approach is the most reliable indicator of the fair values of the businesses.

Upon completion of the annual testing as of May 1, 2015, Phone Hardware goodwill was determined to be impaired.

In the second half of fiscal year 2015, Phone Hardware did not meet its sales volume and revenue goals, and the mix

of units sold had lower margins than planned. These results, along with changes in the competitive marketplace and

an evaluation of business priorities, led to a shift in strategic direction and reduced future revenue and profitability

expectations for the business. As a result of these changes in strategy and expectations, we have forecasted

reductions in unit volume growth rates and lower future cash flows used to estimate the fair value of the Phone

Hardware reporting unit, which resulted in the determination that an impairment adjustment was required.