Microsoft 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

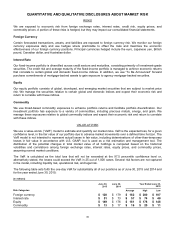

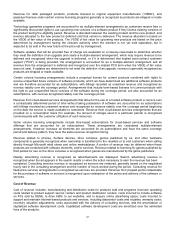

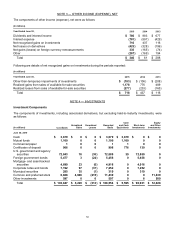

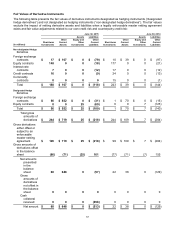

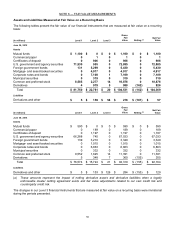

and international equities, and actively traded mutual funds. Our Level 1 derivative assets and liabilities

include those actively traded on exchanges.

• Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for

identical or similar instruments in markets that are not active, and model-based valuation techniques (e.g.

the Black-Scholes model) for which all significant inputs are observable in the market or can be

corroborated by observable market data for substantially the full term of the assets or liabilities. Where

applicable, these models project future cash flows and discount the future amounts to a present value

using market-based observable inputs including interest rate curves, credit spreads, foreign exchange

rates, and forward and spot prices for currencies and commodities. Our Level 2 non-derivative

investments consist primarily of corporate notes and bonds, common and preferred stock, mortgage- and

asset-backed securities, U.S. government and agency securities, and foreign government bonds. Our

Level 2 derivative assets and liabilities primarily include certain over-the-counter option and swap

contracts.

• Level 3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions

that market participants would use in pricing the asset or liability. The fair values are therefore determined

using model-based techniques, including option pricing models and discounted cash flow models. Our

Level 3 non-derivative assets primarily comprise investments in common and preferred stock and goodwill

when it is recorded at fair value due to an impairment charge. Unobservable inputs used in the models are

significant to the fair values of the assets and liabilities. Our Level 3 derivative assets and liabilities

primarily include equity derivatives.

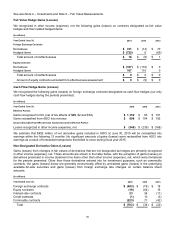

We measure certain assets, including our cost and equity method investments, at fair value on a nonrecurring basis

when they are deemed to be other-than-temporarily impaired. The fair values of these investments are determined

based on valuation techniques using the best information available, and may include quoted market prices, market

comparables, and discounted cash flow projections. An impairment charge is recorded when the cost of the

investment exceeds its fair value and this condition is determined to be other-than-temporary.

Our other current financial assets and our current financial liabilities have fair values that approximate their carrying

values.

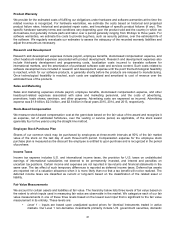

Financial Instruments

We consider all highly liquid interest-earning investments with a maturity of three months or less at the date of

purchase to be cash equivalents. The fair values of these investments approximate their carrying values. In general,

investments with original maturities of greater than three months and remaining maturities of less than one year are

classified as short-term investments. Investments with maturities beyond one year may be classified as short-term

based on their highly liquid nature and because such marketable securities represent the investment of cash that is

available for current operations. All cash equivalents and short-term investments are classified as available-for-sale

and realized gains and losses are recorded using the specific identification method. Changes in market value,

excluding other-than-temporary impairments, are reflected in OCI.

Equity and other investments classified as long-term include both debt and equity instruments. With the exception of

certain corporate notes that are classified as held-to-maturity, debt and publicly-traded equity securities are classified

as available-for-sale and realized gains and losses are recorded using the specific identification method. Changes in

the market value of available-for-sale securities, excluding other-than-temporary impairments, are reflected in OCI.

Held-to-maturity investments are recorded and held at amortized cost. Common and preferred stock and other

investments that are restricted for more than one year or are not publicly traded are recorded at cost or using the

equity method.

We lend certain fixed-income and equity securities to increase investment returns. The loaned securities continue to

be carried as investments on our balance sheet. Cash and/or security interests are received as collateral for the

loaned securities with the amount determined based upon the underlying security lent and the creditworthiness of the

borrower. Cash received is recorded as an asset with a corresponding liability.

Investments are considered to be impaired when a decline in fair value is judged to be other-than-temporary. Fair

value is calculated based on publicly available market information or other estimates determined by management.

We employ a systematic methodology on a quarterly basis that considers available quantitative and qualitative

evidence in evaluating potential impairment of our investments. If the cost of an investment exceeds its fair value, we

evaluate, among other factors, general market conditions, credit quality of debt instrument issuers, the duration and

extent to which the fair value is less than cost, and for equity securities, our intent and ability to hold, or plans to sell,

the investment. For fixed-income securities, we also evaluate whether we have plans to sell the security or it is more