Microsoft 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

about fair value of assets and liabilities becomes available, including additional information relating to tax matters and

finalization of our valuation of identified intangible assets.

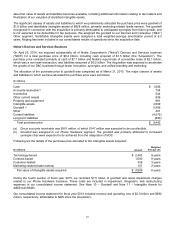

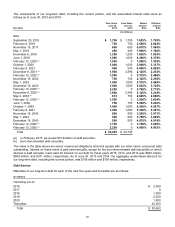

The significant classes of assets and liabilities to which we preliminarily allocated the purchase price were goodwill of

$1.8 billion and identifiable intangible assets of $928 million, primarily marketing-related (trade names). The goodwill

recognized in connection with the acquisition is primarily attributable to anticipated synergies from future growth, and

is not expected to be deductible for tax purposes. We assigned the goodwill to our Devices and Consumer (“D&C”)

Other segment. Identifiable intangible assets were assigned a total weighted-average amortization period of 6.3

years. Mojang has been included in our consolidated results of operations since the acquisition date.

Nokia’s Devices and Services Business

On April 25, 2014, we acquired substantially all of Nokia Corporation’s (“Nokia”) Devices and Services business

(“NDS”) for a total purchase price of $9.4 billion, including cash acquired of $1.5 billion (the “Acquisition”). The

purchase price consisted primarily of cash of $7.1 billion and Nokia’s repurchase of convertible notes of $2.1 billion,

which was a non-cash transaction, and liabilities assumed of $0.2 billion. The Acquisition was expected to accelerate

the growth of our D&C business through faster innovation, synergies, and unified branding and marketing.

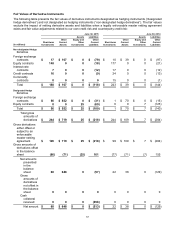

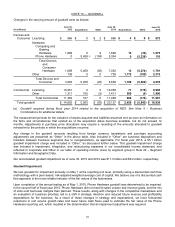

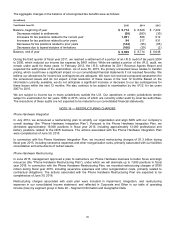

The allocation of the purchase price to goodwill was completed as of March 31, 2015. The major classes of assets

and liabilities to which we have allocated the purchase price were as follows:

(In millions)

Cash $1,506

Accounts receivable (a) 754

Inventories 544

Other current assets 936

Property and equipment 981

Intangible assets 4,509

Goodwill (b) 5,456

Other 221

Current liabilities (4,575)

Long-term liabilities (890)

Total purchase price $ 9,442

(a) Gross accounts receivable was $901 million, of which $147 million was expected to be uncollectible.

(b) Goodwill was assigned to our Phone Hardware segment. The goodwill was primarily attributed to increased

synergies that were expected to be achieved from the integration of NDS.

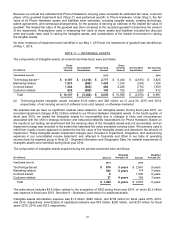

Following are the details of the purchase price allocated to the intangible assets acquired:

(In millions) Amount

Weighted

Average Life

Technology-based $ 2,493 9 years

Contract-based 1,500 9 years

Customer-related 359 3 years

Marketing-related (trade names) 157 2 years

Fair value of intangible assets acquired $ 4,509 8 years

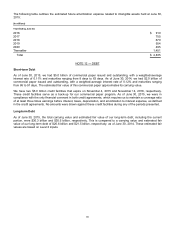

During the fourth quarter of fiscal year 2015, we recorded $7.5 billion of goodwill and asset impairment charges

related to our Phone Hardware business. These costs are included in impairment, integration, and restructuring

expenses in our consolidated income statement. See Note 10 – Goodwill and Note 11 – Intangible Assets for

additional details.

Our consolidated income statement for fiscal year 2014 included revenue and operating loss of $2.0 billion and $692

million, respectively, attributable to NDS since the Acquisition.