Microsoft 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

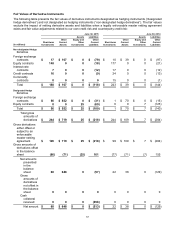

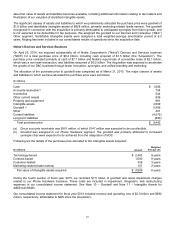

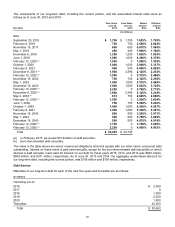

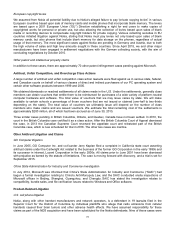

The components of our long-term debt, including the current portion, and the associated interest rates were as

follows as of June 30, 2015 and 2014:

Due Date

Face

V

alue

June 30,

2015

Face

V

alue

June 30,

2014

Stated

Interest

Rate

Effective

Interest

Rate

(In millions)

Notes

September 25, 2015 $1,750 $ 1,750 1.625% 1.795%

February 8, 2016 750 750 2.500% 2.642%

November 15, 2017 600 600 0.875% 1.084%

May 1, 2018 450 450 1.000% 1.106%

December 6, 2018 1,250 1,250 1.625% 1.824%

June 1, 2019 1,000 1,000 4.200% 4.379%

February 12, 2020 (a) 1,500 0 1.850% 1.935%

October 1, 2020 1,000 1,000 3.000% 3.137%

February 8, 2021 500 500 4.000% 4.082%

December 6, 2021 (b) 1,950 2,396 2.125% 2.233%

February 12, 2022 (a) 1,500 0 2.375% 2.466%

November 15, 2022 750 750 2.125% 2.239%

May 1, 2023 1,000 1,000 2.375% 2.465%

December 15, 2023 1,500 1,500 3.625% 3.726%

February 12, 2025 (a) 2,250 0 2.700% 2.772%

December 6, 2028 (b) 1,950 2,396 3.125% 3.218%

May 2, 2033 (b) 613 753 2.625% 2.690%

February 12, 2035 (a) 1,500 0 3.500% 3.604%

June 1, 2039 750 750 5.200% 5.240%

October 1, 2040 1,000 1,000 4.500% 4.567%

February 8, 2041 1,000 1,000 5.300% 5.361%

November 15, 2042 900 900 3.500% 3.571%

May 1, 2043 500 500 3.750% 3.829%

December 15, 2043 500 500 4.875% 4.918%

February 12, 2045 (a) 1,750 0 3.750% 3.800%

February 12, 2055 (a) 2,250 0 4.000% 4.063%

Total $ 30,463 $ 20,745

(a) In February 2015, we issued $10.8 billion of debt securities.

(b) Euro-denominated debt securities.

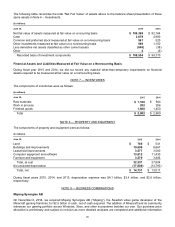

The notes in the table above are senior unsecured obligations and rank equally with our other senior unsecured debt

outstanding. Interest on these notes is paid semi-annually, except for the euro-denominated debt securities on which

interest is paid annually. Cash paid for interest on our debt for fiscal years 2015, 2014, and 2013 was $620 million,

$509 million, and $371 million, respectively. As of June 30, 2015 and 2014, the aggregate unamortized discount for

our long-term debt, including the current portion, was $156 million and $100 million, respectively.

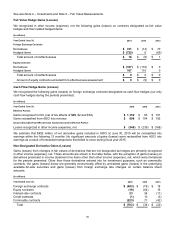

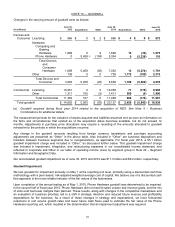

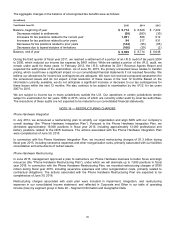

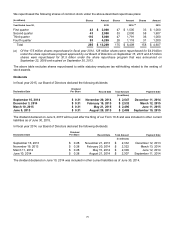

Debt Service

Maturities of our long-term debt for each of the next five years and thereafter are as follows:

(In millions)

Y

ear Ending June 30,

2016 $2,500

2017 0

2018 1,050

2019 2.250

2020 1,500

Thereafter 23,163

Total $ 30,463