Microsoft 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

NOTES TO FINANCIAL STATEMENTS

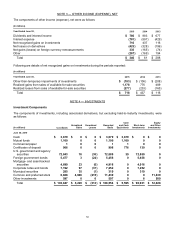

NOTE 1 — ACCOUNTING POLICIES

Accounting Principles

The consolidated financial statements and accompanying notes are prepared in accordance with accounting

principles generally accepted in the United States of America (“U.S. GAAP”).

We have recast certain prior period amounts to conform to the current period presentation, with no impact on

consolidated net income or cash flows.

Principles of Consolidation

The consolidated financial statements include the accounts of Microsoft Corporation and its subsidiaries.

Intercompany transactions and balances have been eliminated. Equity investments through which we are able to

exercise significant influence over but do not control the investee and are not the primary beneficiary of the

investee’s activities are accounted for using the equity method. Investments through which we are not able to

exercise significant influence over the investee and which do not have readily determinable fair values are accounted

for under the cost method.

Estimates and Assumptions

Preparing financial statements requires management to make estimates and assumptions that affect the reported

amounts of assets, liabilities, revenue, and expenses. Examples of estimates include: loss contingencies; product

warranties; the fair value of, and/or potential impairment of goodwill and intangibles assets, for our reporting units;

product life cycles; useful lives of our tangible and intangible assets; allowances for doubtful accounts; allowances for

product returns; the market value of our inventory; and stock-based compensation forfeiture rates. Examples of

assumptions include: the elements comprising a software arrangement, including the distinction between upgrades

or enhancements and new products; when technological feasibility is achieved for our products; the potential

outcome of future tax consequences of events that have been recognized in our consolidated financial statements or

tax returns; and determining when investment impairments are other-than-temporary. Actual results and outcomes

may differ from management’s estimates and assumptions.

Foreign Currencies

Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date.

Revenue and expenses are translated at average rates of exchange prevailing during the year. Translation

adjustments resulting from this process are recorded to other comprehensive income (“OCI”).

Revenue Recognition

Revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or

determinable, and collectability is probable. Revenue generally is recognized net of allowances for returns and any

taxes collected from customers and subsequently remitted to governmental authorities.

Revenue recognition for multiple-element arrangements requires judgment to determine if multiple elements exist,

whether elements can be accounted for as separate units of accounting, and if so, the fair value for each of the

elements.

Microsoft enters into arrangements that can include various combinations of software, services, and hardware.

Where elements are delivered over different periods of time, and when allowed under U.S. GAAP, revenue is

allocated to the respective elements based on their relative selling prices at the inception of the arrangement, and

revenue is recognized as each element is delivered. We use a hierarchy to determine the fair value to be used for

allocating revenue to elements: (i) vendor-specific objective evidence of fair value (“VSOE”), (ii) third-party evidence,

and (iii) best estimate of selling price (“ESP”). For software elements, we follow the industry specific software

guidance which only allows for the use of VSOE in establishing fair value. Generally, VSOE is the price charged

when the deliverable is sold separately or the price established by management for a product that is not yet sold if it

is probable that the price will not change before introduction into the marketplace. ESPs are established as best

estimates of what the selling prices would be if the deliverables were sold regularly on a stand-alone basis. Our

process for determining ESPs requires judgment and considers multiple factors that may vary over time depending

upon the unique facts and circumstances related to each deliverable.