Microsoft 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

million, net of foreign currency remeasurements, as well as an impairment charge of $2.2 billion related to the write-

down of Phone Hardware intangible assets. Restructuring charges were $2.1 billion, including employee severance

expenses and the write-down of certain assets in connection with our restructuring activities. Integration expenses

increased $308 million, due to a full-year of integration activities in fiscal year 2015 associated with the acquisition of

NDS.

Fiscal year 2014 compared with fiscal year 2013

Impairment, integration, and restructuring expenses were $127 million for fiscal year 2014, reflecting integration

expenses associated with the acquisition of NDS. No impairment, integration, and restructuring expenses were

recorded in fiscal year 2013.

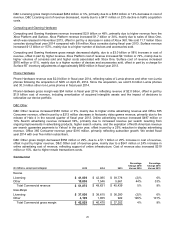

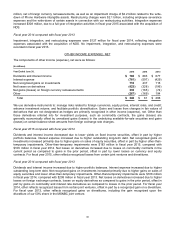

OTHER INCOME (EXPENSE), NET

The components of other income (expense), net were as follows:

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Dividends and interest income $ 766 $ 883 $ 677

Interest expense (781 ) (597) (429)

Net recognized gains on investments 716 437 116

Net losses on derivatives (423 ) (328) (196)

Net gains (losses) on foreign currency remeasurements 335 (165) (74)

Other (267 ) (169) 194

Total $ 346 $ 61 $288

We use derivative instruments to: manage risks related to foreign currencies, equity prices, interest rates, and credit;

enhance investment returns; and facilitate portfolio diversification. Gains and losses from changes in fair values of

derivatives that are not designated as hedges are primarily recognized in other income (expense), net. Other than

those derivatives entered into for investment purposes, such as commodity contracts, the gains (losses) are

generally economically offset by unrealized gains (losses) in the underlying available-for-sale securities and gains

(losses) on certain balance sheet amounts from foreign exchange rate changes.

Fiscal year 2015 compared with fiscal year 2014

Dividends and interest income decreased due to lower yields on fixed income securities, offset in part by higher

portfolio balances. Interest expense increased due to higher outstanding long-term debt. Net recognized gains on

investments increased primarily due to higher gains on sales of equity securities, offset in part by higher other-than-

temporary impairments. Other-than-temporary impairments were $183 million in fiscal year 2015, compared with

$106 million in fiscal year 2014. Net losses on derivatives increased due to losses on commodity contracts in the

current period as compared to gains in the prior period, offset in part by lower losses on currency and equity

contracts. For fiscal year 2015, other reflects recognized losses from certain joint ventures and divestitures.

Fiscal year 2014 compared with fiscal year 2013

Dividends and interest income increased due to higher portfolio balances. Interest expense increased due to higher

outstanding long-term debt. Net recognized gains on investments increased primarily due to higher gains on sales of

equity securities and lower other-than-temporary impairments. Other-than-temporary impairments were $106 million

in fiscal year 2014, compared with $208 million in fiscal year 2013. Net losses on derivatives increased due to higher

losses on foreign exchange contracts, losses on equity derivatives as compared to gains in the prior period, offset in

part by gains on commodity and interest rate derivatives as compared to losses in the prior period. For fiscal year

2014, other reflects recognized losses from certain joint ventures, offset in part by a recognized gain on a divestiture.

For fiscal year 2013, other reflects recognized gains on divestitures, including the gain recognized upon the

divestiture of our 50% share in the MSNBC joint venture.