Microsoft 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

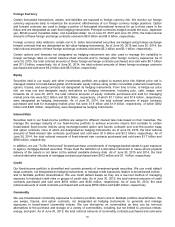

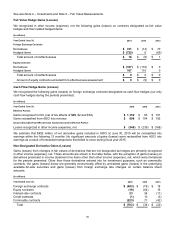

Foreign Currency

Certain forecasted transactions, assets, and liabilities are exposed to foreign currency risk. We monitor our foreign

currency exposures daily to maximize the economic effectiveness of our foreign currency hedge positions. Option

and forward contracts are used to hedge a portion of forecasted international revenue for up to three years in the

future and are designated as cash flow hedging instruments. Principal currencies hedged include the euro, Japanese

yen, British pound, Canadian dollar, and Australian dollar. As of June 30, 2015 and June 30, 2014, the total notional

amounts of these foreign exchange contracts sold were $9.8 billion and $4.9 billion, respectively.

Foreign currency risks related to certain non-U.S. dollar denominated securities are hedged using foreign exchange

forward contracts that are designated as fair value hedging instruments. As of June 30, 2015 and June 30, 2014, the

total notional amounts of these foreign exchange contracts sold were $5.3 billion and $3.1 billion, respectively.

Certain options and forwards not designated as hedging instruments are also used to manage the variability in

foreign exchange rates on certain balance sheet amounts and to manage other foreign currency exposures. As of

June 30, 2015, the total notional amounts of these foreign exchange contracts purchased and sold were $9.7 billion

and $11.0 billion, respectively. As of June 30, 2014, the total notional amounts of these foreign exchange contracts

purchased and sold were $6.2 billion and $8.5 billion, respectively.

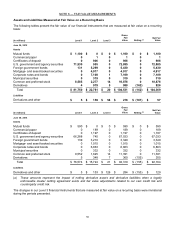

Equity

Securities held in our equity and other investments portfolio are subject to market price risk. Market price risk is

managed relative to broad-based global and domestic equity indices using certain convertible preferred investments,

options, futures, and swap contracts not designated as hedging instruments. From time to time, to hedge our price

risk, we may use and designate equity derivatives as hedging instruments, including puts, calls, swaps, and

forwards. As of June 30, 2015, the total notional amounts of equity contracts purchased and sold for managing

market price risk were $2.2 billion and $2.6 billion, respectively, of which $1.1 billion and $1.4 billion, respectively,

were designated as hedging instruments. As of June 30, 2014, the total notional amounts of equity contracts

purchased and sold for managing market price risk were $1.9 billion and $1.9 billion, respectively, of which $362

million and $420 million, respectively, were designated as hedging instruments.

Interest Rate

Securities held in our fixed-income portfolio are subject to different interest rate risks based on their maturities. We

manage the average maturity of our fixed-income portfolio to achieve economic returns that correlate to certain

broad-based fixed-income indices using exchange-traded option and futures contracts and over-the-counter swap

and option contracts, none of which are designated as hedging instruments. As of June 30, 2015, the total notional

amounts of fixed-interest rate contracts purchased and sold were $1.0 billion and $3.2 billion, respectively. As of

June 30, 2014, the total notional amounts of fixed-interest rate contracts purchased and sold were $1.7 billion and

$936 million, respectively.

In addition, we use “To Be Announced” forward purchase commitments of mortgage-backed assets to gain exposure

to agency mortgage-backed securities. These meet the definition of a derivative instrument in cases where physical

delivery of the assets is not taken at the earliest available delivery date. As of June 30, 2015 and 2014, the total

notional derivative amounts of mortgage contracts purchased were $812 million and $1.1 billion, respectively.

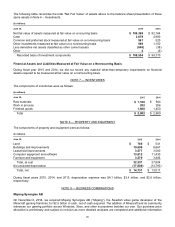

Credit

Our fixed-income portfolio is diversified and consists primarily of investment-grade securities. We use credit default

swap contracts, not designated as hedging instruments, to manage credit exposures relative to broad-based indices

and to facilitate portfolio diversification. We use credit default swaps as they are a low-cost method of managing

exposure to individual credit risks or groups of credit risks. As of June 30, 2015, the total notional amounts of credit

contracts purchased and sold were $618 million and $430 million, respectively. As of June 30, 2014, the total

notional amounts of credit contracts purchased and sold were $550 million and $440 million, respectively.

Commodity

We use broad-based commodity exposures to enhance portfolio returns and to facilitate portfolio diversification. We

use swaps, futures, and option contracts, not designated as hedging instruments, to generate and manage

exposures to broad-based commodity indices. We use derivatives on commodities as they can be low-cost

alternatives to the purchase and storage of a variety of commodities, including, but not limited to, precious metals,

energy, and grain. As of June 30, 2015, the total notional amounts of commodity contracts purchased and sold were