Microsoft 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

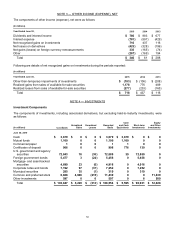

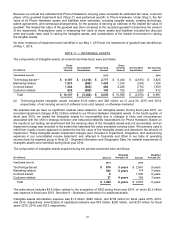

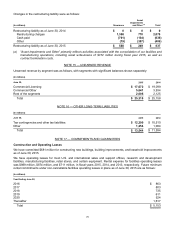

Following are the supplemental consolidated results of Microsoft Corporation on an unaudited pro forma basis, as if

the Acquisition had been consummated on July 1, 2012:

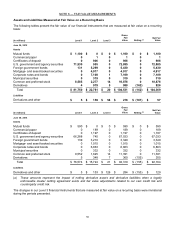

(In millions, except per share amounts)

Y

ear Ended June 30, 2014 2013

Revenue $ 96,248 $ 93,243

Net income $ 20,234 $ 20,153

Diluted earnings per share $ 2.41 $2.38

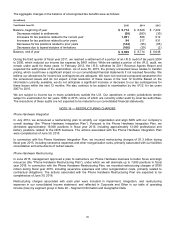

These pro forma results were based on estimates and assumptions, which we believe are reasonable. They are not

the results that would have been realized had we been a combined company during the periods presented and are

not necessarily indicative of our consolidated results of operations in future periods. The pro forma results include

adjustments primarily related to purchase accounting adjustments and the elimination of related party transactions

between Microsoft and NDS. Acquisition costs and other nonrecurring charges incurred are included in the earliest

period presented.

During the fourth quarter of fiscal year 2014, we incurred $21 million of acquisition costs associated with the

purchase of NDS. Acquisition costs are primarily comprised of transaction fees and direct acquisition costs, including

legal, finance, consulting, and other professional fees. These costs are included in impairment, integration, and

restructuring expenses on our consolidated income statement for fiscal year 2014.

Certain concurrent transactions were recognized separately from the Acquisition. Prior to the Acquisition, we had

joint strategic initiatives with Nokia; this contractual relationship was terminated in conjunction with the Acquisition.

No gain or loss was recorded upon termination of this agreement, as it was determined to be at market value. In

addition, we agreed to license Nokia’s mapping services and will pay Nokia separately for the services provided

under a four-year license as they are rendered.

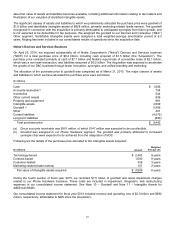

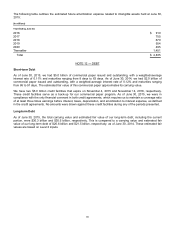

Yammer

On July 18, 2012, we acquired Yammer, Inc. (“Yammer”), a leading provider of enterprise social networks, for $1.1

billion in cash. Yammer added an enterprise social networking service to Microsoft’s portfolio of complementary

cloud-based services. The major classes of assets to which we allocated the purchase price were goodwill of $937

million and identifiable intangible assets of $178 million. We assigned the goodwill to Commercial Other under our

current segment structure. Yammer was consolidated into our results of operations starting on the acquisition date.

Other

During fiscal year 2015, we completed 15 additional acquisitions for total cash consideration of $892 million. These

entities have been included in our consolidated results of operations since their respective acquisition dates.

Pro forma results of operations for Mojang and our other acquisitions during the current period have not been

presented because the effects of these business combinations, individually and in aggregate, were not material to

our consolidated results of operations.