Microsoft 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

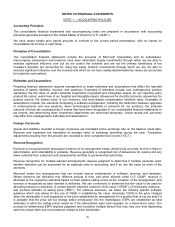

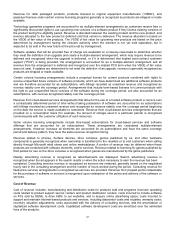

Goodwill

Goodwill is tested for impairment at the reporting unit level (operating segment or one level below an operating

segment) on an annual basis (May 1 for us) and between annual tests if an event occurs or circumstances change

that would more likely than not reduce the fair value of a reporting unit below its carrying value.

Intangible Assets

All of our intangible assets are subject to amortization and are amortized using the straight-line method over their

estimated period of benefit, ranging from one to 15 years. We evaluate the recoverability of intangible assets

periodically by taking into account events or circumstances that may warrant revised estimates of useful lives or that

indicate the asset may be impaired.

Recent Accounting Guidance Not Yet Adopted

In May 2014, as part of its ongoing efforts to assist in the convergence of U.S. GAAP and International Financial

Reporting Standards, the Financial Accounting Standards Board (“FASB”) issued a new standard related to revenue

recognition. Under the new standard, recognition of revenue occurs when a customer obtains control of promised

goods or services in an amount that reflects the consideration which the entity expects to receive in exchange for

those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty

of revenue and cash flows arising from contracts with customers. The new standard will be effective for us beginning

July 1, 2018, and adoption as of the original effective date of July 1, 2017 is permitted. We anticipate this standard

will have a material impact on our consolidated financial statements, and we are currently evaluating its impact.

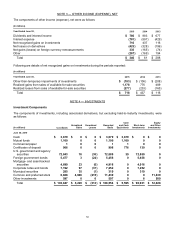

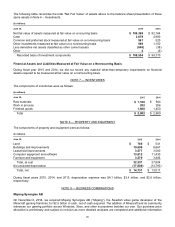

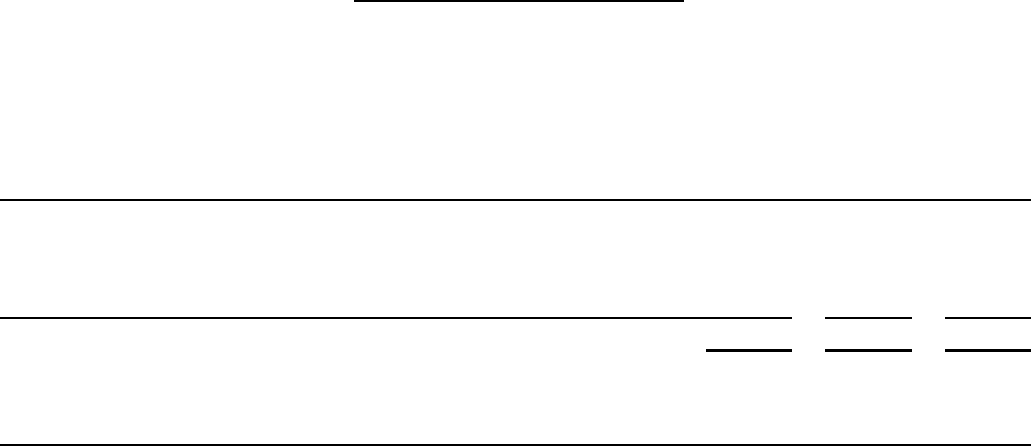

NOTE 2 — EARNINGS PER SHARE

Basic earnings per share (“EPS”) is computed based on the weighted average number of shares of common stock

outstanding during the period. Diluted EPS is computed based on the weighted average number of shares of

common stock plus the effect of dilutive potential common shares outstanding during the period using the treasury

stock method. Dilutive potential common shares include outstanding stock options and stock awards.

The components of basic and diluted EPS were as follows:

(In millions, except earnings per share)

Y

ear Ended June 30, 2015

2014 2013

Net income available for common shareholders (A) $ 12,193 $ 22,074 $ 21,863

Weighted average outstanding shares of common stock (B) 8,177 8,299 8,375

Dilutive effect of stock-based awards 77 100 95

Common stock and common stock equivalents (C) 8,254 8,399 8,470

Earnings Per Share

Basic (A/B) $1.49 $ 2.66 $2.61

Diluted (A/C) $1.48 $ 2.63 $2.58

Anti-dilutive stock-based awards excluded from the calculations of diluted EPS were immaterial during the periods

presented.