Microsoft 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

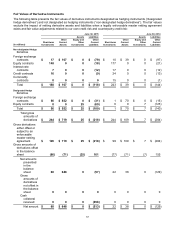

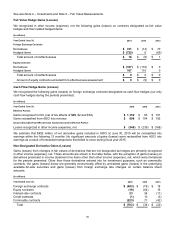

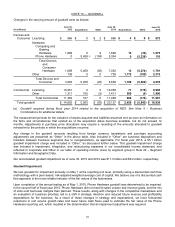

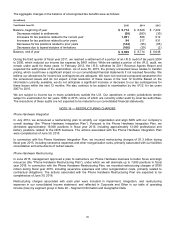

NOTE 6 — FAIR VALUE MEASUREMENTS

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following tables present the fair value of our financial instruments that are measured at fair value on a recurring

basis:

(In millions) Level 1 Level 2 Level 3

Gross

Fair

Value

Netting (a)

Net Fair

Value

June 30, 2015

Assets

Mutual funds $1,100 $ 0 $ 0 $ 1,100 $ 0 $1,100

Commercial paper 0 1 0 1 0 1

Certificates of deposit 0 906 0 906 0 906

U.S. government and agency securities 71,930 955 0 72,885 0 72,885

Foreign government bonds 131 5,299 0 5,430 0 5,430

Mortgage- and asset-backed securities 0 4,917 0 4,917 0 4,917

Corporate notes and bonds 0 7,108 1 7,109 0 7,109

Municipal securities 0 319 0 319 0 319

Common and preferred stock 8,585 2,277 14 10,876 0 10,876

Derivatives 4 979 5 988 (162) 826

Total $81,750 $ 22,761 $ 20 $ 104,531 $ (162) $ 104,369

Liabilities

Derivatives and other $ 5 $ 159 $ 54 $ 218 $ (161) $57

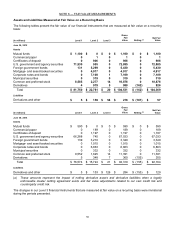

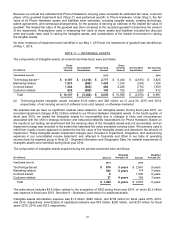

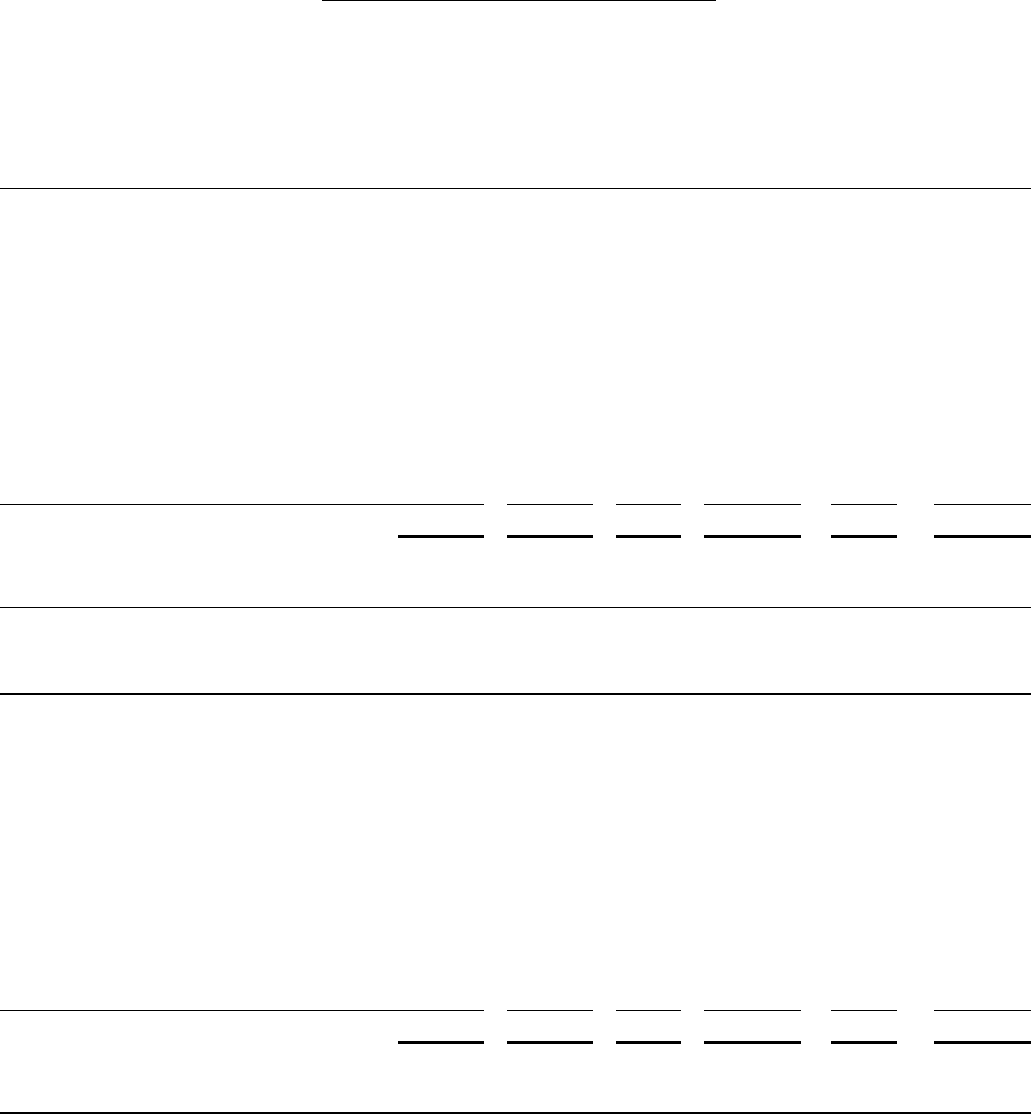

(In millions) Level 1 Level 2 Level 3

Gross

Fair

Value

Netting (a)

Net Fair

Value

June 30, 2014

Assets

Mutual funds $590 $0 $0 $590 $ 0 $590

Commercial paper 0 189 0 189 0 189

Certificates of deposit 0 1,197 0 1,197 0 1,197

U.S. government and agency securities 66,288 745 0 67,033 0 67,033

Foreign government bonds 139 3,210 0 3,349 0 3,349

Mortgage- and asset-backed securities 0 1,015 0 1,015 0 1,015

Corporate notes and bonds 0 6,863 0 6,863 0 6,863

Municipal securities 0 332 0 332 0 332

Common and preferred stock 9,552 1,825 14 11,391 0 11,391

Derivatives 5 348 7 360 (155) 205

Total $ 76,574 $ 15,724 $21 $92,319 $ (155) $92,164

Liabilities

Derivatives and other $5 $153 $ 126 $284 $ (155) $129

(a) These amounts represent the impact of netting derivative assets and derivative liabilities when a legally

enforceable master netting agreement exists and fair value adjustments related to our own credit risk and

counterparty credit risk.

The changes in our Level 3 financial instruments that are measured at fair value on a recurring basis were immaterial

during the periods presented.