Microsoft 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

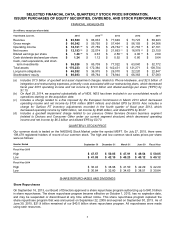

SELECTED FINANCIAL DATA, QUARTERLY STOCK PRICE INFORMATION,

ISSUER PURCHASES OF EQUITY SECURITIES, DIVIDENDS, AND STOCK PERFORMANCE

FINANCIAL HIGHLIGHTS

(In millions, except per share data)

Y

ear Ended June 30, 2015 2014

(b)

2013 2012 2011

Revenue $ 93,580 $86,833 $77,849 $ 73,723 $69,943

Gross margin $ 60,542 $59,755 $57,464 $ 56,193 $54,366

Operating income $ 18,161 (a) $27,759 $26,764 (c) $ 21,763

(d) $ 27,161

Net income $ 12,193 (a) $22,074 $21,863 (c) $ 16,978

(d) $ 23,150

Diluted earnings per share $ 1.48 (a) $2.63 $2.58 (c) $ 2.00

(d) $ 2.69

Cash dividends declared per share $ 1.24 $1.12 $0.92 $ 0.80 $0.64

Cash, cash equivalents, and short-

term investments $ 96,526 $85,709 $77,022 $ 63,040 $52,772

Total assets $ 176,223 $ 172,384 $ 142,431 $ 121,271 $ 108,704

Long-term obligations $ 46,282 $36,975 $26,070 $ 22,220 $22,847

Stockholders’ equity $ 80,083 $89,784 $78,944 $ 66,363 $57,083

(a) Includes $7.5 billion of goodwill and asset impairment charges related to Phone Hardware, and $2.5 billion of

integration and restructuring expenses, primarily costs associated with our restructuring plans, which decreased

fiscal year 2015 operating income and net income by $10.0 billion and diluted earnings per share (“EPS”) by

$1.15.

(b) On April 25, 2014, we acquired substantially all of NDS. NDS has been included in our consolidated results of

operations starting on the acquisition date.

(c) Includes a charge related to a fine imposed by the European Commission in March 2013 which decreased

operating income and net income by $733 million (€561 million) and diluted EPS by $0.09. Also includes a

charge for Surface RT inventory adjustments recorded in the fourth quarter of fiscal year 2013, which

decreased operating income by $900 million, net income by $596 million, and diluted EPS by $0.07.

(d) Includes a goodwill impairment charge related to our previous Online Services Division business segment

(related to Devices and Consumer Other under our current segment structure) which decreased operating

income and net income by $6.2 billion and diluted EPS by $0.73.

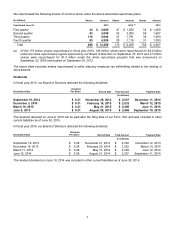

QUARTERLY STOCK PRICE

Our common stock is traded on the NASDAQ Stock Market under the symbol MSFT. On July 27, 2015, there were

109,479 registered holders of record of our common stock. The high and low common stock sales prices per share

were as follows:

Quarter Ended September 30 December 31 March 31

June 30 Fiscal Year

Fiscal Year 2015

High $ 47.57 $ 50.05 $ 47.91 $ 49.54 $ 50.05

Low $ 41.05 $ 42.10 $ 40.23 $ 40.12 $ 40.12

Fiscal Year 2014

High $ 36.43 $ 38.98 $ 41.50 $ 42.29 $ 42.29

Low $ 30.84 $ 32.80 $ 34.63 $ 38.51 $ 30.84

SHARE REPURCHASES AND DIVIDENDS

Share Repurchases

On September 16, 2013, our Board of Directors approved a share repurchase program authorizing up to $40.0 billion

in share repurchases. The share repurchase program became effective on October 1, 2013, has no expiration date,

and may be suspended or discontinued at any time without notice. This share repurchase program replaced the

share repurchase program that was announced on September 22, 2008 and expired on September 30, 2013. As of

June 30, 2015, $21.9 billion remained of our $40.0 billion share repurchase program. All repurchases were made

using cash resources.