Microsoft 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

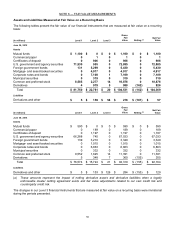

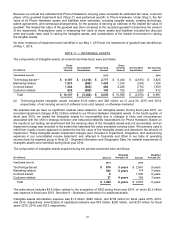

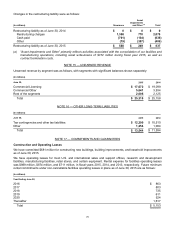

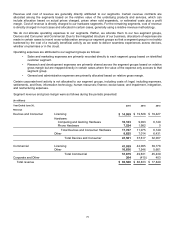

The aggregate changes in the balance of unrecognized tax benefits were as follows:

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Balance, beginning of year $ 8,714 $ 8,648 $ 7,202

Decreases related to settlements (50 ) (583) (30)

Increases for tax positions related to the current year 1,091 566 612

Increases for tax positions related to prior years 94 217 931

Decreases for tax positions related to prior years (144 ) (95) (65)

Decreases due to lapsed statutes of limitations (106 ) (39) (2)

Balance, end of year $9,599 $ 8,714 $8,648

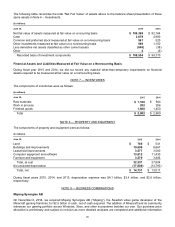

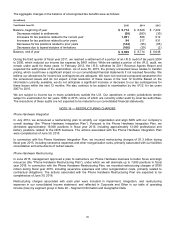

During the third quarter of fiscal year 2011, we reached a settlement of a portion of an I.R.S. audit of tax years 2004

to 2006, which reduced our income tax expense by $461 million. While we settled a portion of the I.R.S. audit, we

remain under audit for these years. In February 2012, the I.R.S. withdrew its 2011 Revenue Agents Report and

reopened the audit phase of the examination. As of June 30, 2015, the primary unresolved issue relates to transfer

pricing, which could have a significant impact on our consolidated financial statements if not resolved favorably. We

believe our allowances for income tax contingencies are adequate. We have not received a proposed assessment for

the unresolved issues and do not expect a final resolution of these issues in the next 12 months. Based on the

information currently available, we do not anticipate a significant increase or decrease to our tax contingencies for

these issues within the next 12 months. We also continue to be subject to examination by the I.R.S. for tax years

2007 to 2015.

We are subject to income tax in many jurisdictions outside the U.S. Our operations in certain jurisdictions remain

subject to examination for tax years 1996 to 2015, some of which are currently under audit by local tax authorities.

The resolutions of these audits are not expected to be material to our consolidated financial statements.

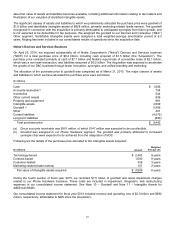

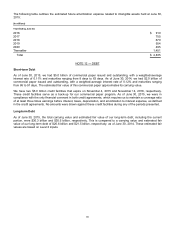

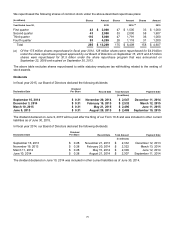

NOTE 14 — RESTRUCTURING CHARGES

Phone Hardware Integration

In July 2014, we announced a restructuring plan to simplify our organization and align NDS with our company’s

overall strategy (the “Phone Hardware Integration Plan”). Pursuant to the Phone Hardware Integration Plan, we

eliminated approximately 19,000 positions in fiscal year 2015, including approximately 13,000 professional and

factory positions related to the NDS business. The actions associated with the Phone Hardware Integration Plan

were completed as of June 30, 2015.

In connection with the Phone Hardware Integration Plan, we incurred restructuring charges of $1.3 billion during

fiscal year 2015, including severance expenses and other reorganization costs, primarily associated with our facilities

consolidation and write-downs of certain assets.

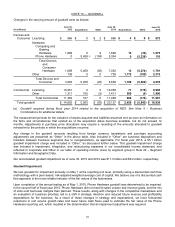

Phone Hardware Restructuring

In June 2015, management approved a plan to restructure our Phone Hardware business to better focus and align

resources (the “Phone Hardware Restructuring Plan”), under which we will eliminate up to 7,800 positions in fiscal

year 2016. In connection with the Phone Hardware Restructuring Plan, we recorded restructuring charges of $780

million during fiscal year 2015, including severance expenses and other reorganization costs, primarily related to

contractual obligations. The actions associated with the Phone Hardware Restructuring Plan are expected to be

completed as of June 30, 2016.

Restructuring charges associated with each plan were included in impairment, integration, and restructuring

expenses in our consolidated income statement, and reflected in Corporate and Other in our table of operating

income (loss) by segment group in Note 22 – Segment Information and Geographic Data.