Microsoft 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

See also Note 4 – Investments and Note 6 – Fair Value Measurements.

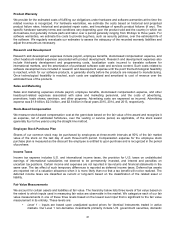

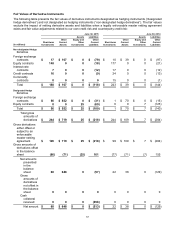

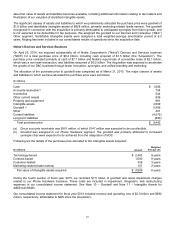

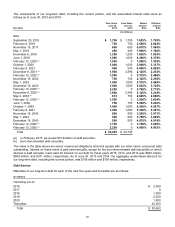

Fair Value Hedge Gains (Losses)

We recognized in other income (expense), net the following gains (losses) on contracts designated as fair value

hedges and their related hedged items:

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Foreign Exchange Contracts

Derivatives $ 741 $ (14) $ 70

Hedged items $ (725 ) 6 (69)

Total amount of ineffectiveness $ 16 $ (8) $1

Equity Contracts

Derivatives $ (107 ) $ (110) $0

Hedged items 107 110 0

Total amount of ineffectiveness $ 0 $ 0 $0

Amount of equity contracts excluded from effectiveness assessment $ 0 $ (9) $0

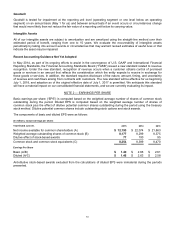

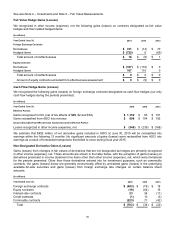

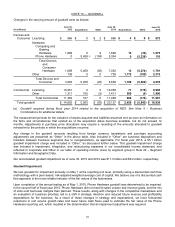

Cash Flow Hedge Gains (Losses)

We recognized the following gains (losses) on foreign exchange contracts designated as cash flow hedges (our only

cash flow hedges during the periods presented):

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Effective Portion

Gains recognized in OCI (net of tax effects of $35, $2 and $54) $ 1,152 $ 63 $ 101

Gains reclassified from AOCI into revenue $ 608 $ 104 $195

Amount Excluded from Effectiveness Assessment and Ineffective Portion

Losses recognized in other income (expense), net $ (346 ) $ (239) $(168)

We estimate that $492 million of net derivative gains included in AOCI at June 30, 2015 will be reclassified into

earnings within the following 12 months. No significant amounts of gains (losses) were reclassified from AOCI into

earnings as a result of forecasted transactions that failed to occur during fiscal year 2015.

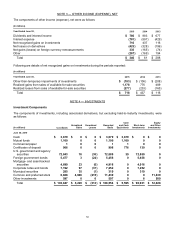

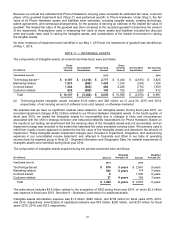

Non-Designated Derivative Gains (Losses)

Gains (losses) from changes in fair values of derivatives that are not designated as hedges are primarily recognized

in other income (expense), net. These amounts are shown in the table below, with the exception of gains (losses) on

derivatives presented in income statement line items other than other income (expense), net, which were immaterial

for the periods presented. Other than those derivatives entered into for investment purposes, such as commodity

contracts, the gains (losses) below are generally economically offset by unrealized gains (losses) in the underlying

available-for-sale securities and gains (losses) from foreign exchange rate changes on certain balance sheet

amounts.

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Foreign exchange contracts $ (483 ) $ (78) $ 18

Equity contracts (19 ) (64) 16

Interest-rate contracts 23 24 (11)

Credit contracts (1 ) 13 (3)

Commodity contracts (223 ) 71 (42)

Total $ (703 ) $ (34) $ (22)