Microsoft 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

NOTE 13 — INCOME TAXES

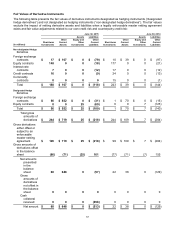

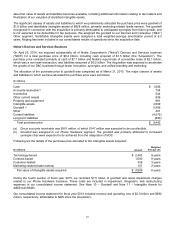

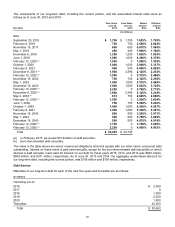

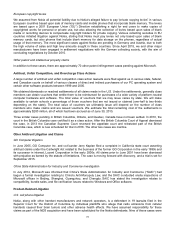

The components of the provision for income taxes were as follows:

(In millions)

Y

ear Ended June 30, 2015

2014 2013

Current Taxes

U.S. federal $ 3,661 $ 3,738 $ 3,131

U.S. state and local 364 266 332

Foreign 2,065 2,073 1,745

Current taxes 6,090 6,077 5,208

Deferred Taxes

Deferred taxes 224 (331) (19)

Provision for income taxes $6,314 $ 5,746 $5,189

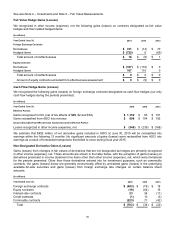

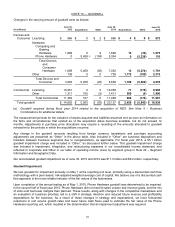

U.S. and foreign components of income before income taxes were as follows:

(In millions)

Y

ear Ended June 30, 2015

2014 2013

U.S. $7,363 $ 7,127 $6,674

Foreign 11,144 20,693 20,378

Income before income taxes $ 18,507 $ 27,820 $ 27,052

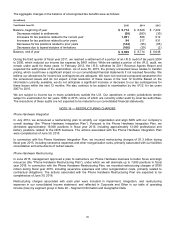

The items accounting for the difference between income taxes computed at the U.S. federal statutory rate and our

effective rate were as follows:

Y

ear Ended June 30, 2015

2014 2013

Federal statutory rate 35.0% 35.0% 35.0%

Effect of:

Foreign earnings taxed at lower rates (20.9)% (17.1)% (17.5)%

Phone Hardware nondeductible charges and valuation allowance 19.1% 0.9% 0%

Domestic production activities deduction (2.4)% (1.0)% (1.2)%

Other reconciling items, net 3.3% 2.9% 2.9%

Effective rate 34.1% 20.7% 19.2%

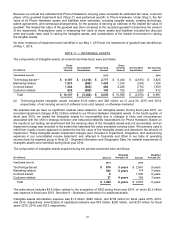

The reduction from the federal statutory rate is primarily due to foreign earnings taxed at lower rates resulting from

producing and distributing our products and services through our foreign regional operations centers in Ireland,

Singapore, and Puerto Rico. In fiscal year 2015, this reduction was mostly offset by losses in foreign jurisdictions for

which we may not realize a tax benefit, primarily as a result of impairment and restructuring charges. Excluding these

losses, our foreign earnings, which are taxed at rates lower than the U.S. rate and are generated from our regional

operating centers, were 73%, 81%, and 79% of our foreign income before tax in fiscal years 2015, 2014, and 2013,

respectively. In general, other reconciling items consist of interest, U.S. state income taxes, and credits. In fiscal

years 2015, 2014, and 2013, there were no individually significant other reconciling items.