Microsoft 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

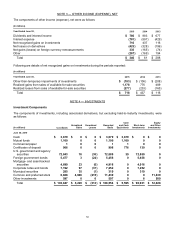

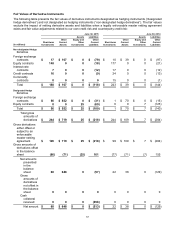

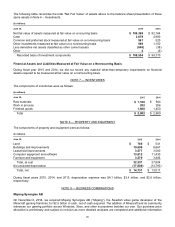

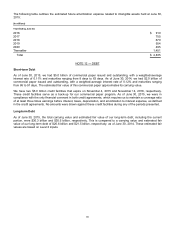

Fair Values of Derivative Instruments

The following table presents the fair values of derivative instruments designated as hedging instruments (“designated

hedge derivatives”) and not designated as hedging instruments (“non-designated hedge derivatives”). The fair values

exclude the impact of netting derivative assets and liabilities when a legally enforceable master netting agreement

exists and fair value adjustments related to our own credit risk and counterparty credit risk:

June 30, 2015 June 30, 2014

A

ssets Liabilities Assets Liabilities

(In millions)

Short-term

Investments

Other

Current

Assets

Equit

y

and

Other

Investments

Other

Current

Liabilities

Short-term

Investments

Other

Current

Assets

Equit

y

and

Other

Investments

Other

Current

Liabilities

Non-designated Hedge

Derivatives

Foreign exchange

contracts $ 17 $ 167 $ 0 $ (79)$ 10 $39 $ 0 $(97)

Equity contracts 148 0 0 (18) 177 0 0 (21)

Interest rate

contracts 7 0 0 (12) 17 0 0 (12)

Credit contracts 16 0 0 (9) 24 0 0 (13)

Commodity

contracts 0 0 0 0 15 0 0 (1)

Total $ 188 $ 167 $ 0 $ (118)$ 243 $39 $ 0 $ (144)

Designated Hedge

Derivatives

Foreign exchange

contracts $ 56 $ 552 $ 0 $ (31)$ 1 $70 $ 0 $(15)

Equity contracts 0 0 25 (69) 0 0 7 (125)

Total $ 56 $ 552 $ 25 $ (100)$ 1 $70 $ 7 $(140)

Total gross

amounts of

derivatives $ 244 $ 719 $ 25 $ (218)$ 244 $ 109 $ 7 $(284)

Gross derivatives

either offset or

subject to an

enforceable

master netting

agreement $ 126 $ 719 $ 25 $ (218)$ 99 $109 $ 7 $(284)

Gross amounts of

derivatives offset

in the balance

sheet (66 ) (71 ) (25) 161 (77) (71 ) (7) 155

Net amounts

presented

in the

balance

sheet 60 648 0 (57) 22 38 0 (129)

Gross

amounts of

derivatives

not offset in

the balance

sheet 0 0 0 0 0 0 0 0

Cash

collateral

received 0 0 0 (456) 0 0 0 0

Net amount $ 60 $ 648 $ 0 $ (513)$ 22 $38 $ 0 $(129)