Microsoft 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

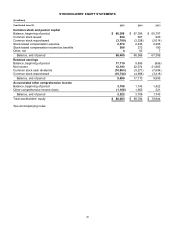

53

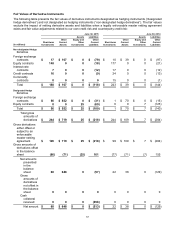

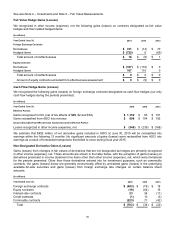

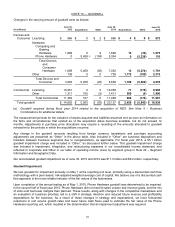

(In millions) Cost Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Cash

and Cash

Equivalents

Short-term

Investments

Equity

and Other

Investments

June 30, 2014

Cash $ 4,980 $ 0 $0 $4,980 $4,980 $ 0 $0

Mutual funds 590 0 0 590 590 0 0

Commercial paper 189 0 0 189 89 100 0

Certificates of deposit 1,197 0 0 1,197 865 332 0

U.S. government and

agency securities 66,952 103 (29) 67,026 109 66,917 0

Foreign government

bonds 3,328 17 (10) 3,335 2,027 1,308 0

Mortgage- and asset-

backed securities 991 30 (2) 1,019 0 1,019 0

Corporate notes and

bonds 6,845 191 (9) 7,027 9 7,018 0

Municipal securities 287 45 0 332 0 332 0

Common and preferred

stock 6,785 5,207 (81) 11,911 0 0 11,911

Other investments 1,164 0 0 1,164 0 14 1,150

Total $ 93,308 $ 5,593 $ (131) $ 98,770 $ 8,669 $ 77,040 $ 13,061

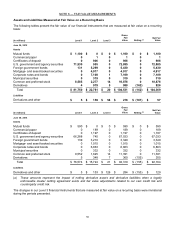

In addition to the investments in the table above, we also own corporate notes that are classified as held-to-maturity

investments, which are included in equity and other investments on the balance sheet. These corporate notes are

due October 31, 2023 and are measured at fair value on a nonrecurring basis. As of June 30, 2015, the amortized

cost and recorded basis of these corporate notes were both $25 million with an estimated fair value that

approximates the carrying value. As of June 30, 2014, the amortized cost, recorded basis, and estimated fair value of

these corporate notes was $1.5 billion, $1.5 billion, and $1.7 billion, respectively, while their associated gross

unrealized holding gains were $164 million.

As of June 30, 2015 and 2014, the recorded bases of common and preferred stock that are restricted for more than

one year or are not publicly traded were $561 million and $520 million, respectively. These investments are carried at

cost and are reviewed quarterly for indicators of other-than-temporary impairment. It is not practicable for us to

reliably estimate the fair value of these investments.

We lend certain fixed-income and equity securities to increase investment returns. These transactions are accounted

for as secured borrowings and the loaned securities continue to be carried as investments on our balance sheet.

Cash and/or security interests are received as collateral for the loaned securities with the amount determined based

upon the underlying security lent and the creditworthiness of the borrower. As of June 30, 2015, collateral received

under these agreements totaled $92 million which is comprised of $79 million of certificates of deposit and $13

million of U.S. government and agency securities. The contractual maturities of these agreements are primarily on a

continuous and overnight basis.