Microsoft 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

FINANCIAL CONDITION

Cash, Cash Equivalents, and Investments

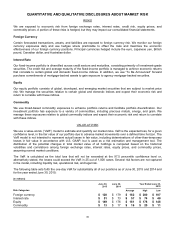

Cash, cash equivalents, and short-term investments totaled $96.5 billion as of June 30, 2015, compared with $85.7

billion as of June 30, 2014. Equity and other investments were $12.1 billion as of June 30, 2015, compared with

$14.6 billion as of June 30, 2014. Our short-term investments are primarily to facilitate liquidity and for capital

preservation. They consist predominantly of highly liquid investment-grade fixed-income securities, diversified among

industries and individual issuers. The investments are predominantly U.S. dollar-denominated securities, but also

include foreign currency-denominated securities in order to diversify risk. Our fixed-income investments are exposed

to interest rate risk and credit risk. The credit risk and average maturity of our fixed-income portfolio are managed to

achieve economic returns that correlate to certain fixed-income indices. The settlement risk related to these

investments is insignificant given that the short-term investments held are primarily highly liquid investment-grade

fixed-income securities.

Of the cash, cash equivalents, and short-term investments at June 30, 2015, $94.4 billion was held by our foreign

subsidiaries and would be subject to material repatriation tax effects. The amount of cash, cash equivalents, and

short-term investments held by foreign subsidiaries subject to other restrictions on the free flow of funds (primarily

currency and other local regulatory) was $2.1 billion. As of June 30, 2015, approximately 79% of the cash

equivalents and short-term investments held by our foreign subsidiaries were invested in U.S. government and

agency securities, approximately 5% were invested in corporate notes and bonds of U.S. companies, and

approximately 5% were invested in U.S. mortgage- and asset-backed securities, all of which are denominated in U.S.

dollars.

Securities lending

We lend certain fixed-income and equity securities to increase investment returns. The loaned securities continue to

be carried as investments on our balance sheet. Cash and/or security interests are received as collateral for the

loaned securities with the amount determined based upon the underlying security lent and the creditworthiness of the

borrower. Cash received is recorded as an asset with a corresponding liability. Our securities lending payable

balance was $92 million as of June 30, 2015. Our average and maximum securities lending payable balances for the

fiscal year were $287 million and $750 million, respectively. Intra-year variances in the amount of securities loaned

are mainly due to fluctuations in the demand for the securities.

Valuation

In general, and where applicable, we use quoted prices in active markets for identical assets or liabilities to

determine the fair value of our financial instruments. This pricing methodology applies to our Level 1 investments,

such as exchange-traded mutual funds, domestic and international equities, and U.S. government securities. If

quoted prices in active markets for identical assets or liabilities are not available to determine fair value, then we use

quoted prices for similar assets and liabilities or inputs other than the quoted prices that are observable either directly

or indirectly. This pricing methodology applies to our Level 2 investments such as corporate notes and bonds,

common and preferred stock, foreign government bonds, mortgage- and asset-backed securities, U.S. government

and agency securities, and certificates of deposit. Level 3 investments are valued using internally developed models

with unobservable inputs. Assets and liabilities measured at fair value on a recurring basis using unobservable inputs

are an immaterial portion of our portfolio.

A majority of our investments are priced by pricing vendors and are generally Level 1 or Level 2 investments as

these vendors either provide a quoted market price in an active market or use observable inputs for their pricing

without applying significant adjustments. Broker pricing is used mainly when a quoted price is not available, the

investment is not priced by our pricing vendors, or when a broker price is more reflective of fair values in the market

in which the investment trades. Our broker-priced investments are generally classified as Level 2 investments

because the broker prices these investments based on similar assets without applying significant adjustments. In

addition, all of our broker-priced investments have a sufficient level of trading volume to demonstrate that the fair

values used are appropriate for these investments. Our fair value processes include controls that are designed to

ensure appropriate fair values are recorded. These controls include model validation, review of key model inputs,

analysis of period-over-period fluctuations, and independent recalculation of prices where appropriate.