MasterCard 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

95

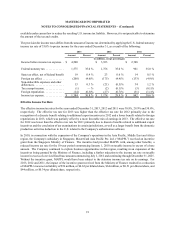

acquirers and merchants. MasterCard or financial institutions establish default interchange fees in certain circumstances

that apply when there is no other interchange fee arrangement between the issuer and the acquirer. MasterCard

establishes a variety of interchange rates depending on such considerations as the location and the type of transaction,

collects the interchange fee on behalf of the institutions entitled to receive it and remits the interchange fee to eligible

institutions. MasterCard's interchange fees and other practices are subject to regulatory and/or legal review and/or

challenges in a number of jurisdictions, including the proceedings described below. At this time, it is not possible to

determine the ultimate resolution of, or estimate the liability related to, any of these interchange proceedings (except

as otherwise indicated below), as the proceedings involve complex claims and/or substantial uncertainties and, in some

cases, could include unascertainable damages or fines. Except as described below, no provision for losses has been

provided in connection with them. Some of the proceedings described below could have a significant impact on our

customers in the applicable country and on MasterCard’s level of business in those countries. The proceedings reflect

the significant and intense legal, regulatory and legislative scrutiny worldwide that interchange fees and acceptance

practices have been receiving. When taken as a whole, the resulting decisions, regulations and legislation with respect

to interchange fees and acceptance practices may have a material adverse effect on the Company’s prospects for future

growth and its overall results of operations, financial position and cash flows.

United States. In June 2005, the first of a series of complaints were filed on behalf of merchants (the majority of the

complaints are styled as class actions, although a few complaints were filed on behalf of individual merchant plaintiffs)

against MasterCard International Incorporated, Visa U.S.A., Inc., Visa International Service Association and a number

of financial institutions. Taken together, the claims in the complaints are generally brought under both Sections 1 and

2 of the Sherman Act, which prohibit monopolization and attempts or conspiracies to monopolize a particular industry,

and some of these complaints contain unfair competition law claims under state law. The complaints allege, among

other things, that MasterCard, Visa, and certain financial institutions conspired to set the price of interchange fees,

enacted point of sale acceptance rules (including the no surcharge rule) in violation of antitrust laws and engaged in

unlawful tying and bundling of certain products and services. The cases have been consolidated for pre-trial proceedings

in the U.S. District Court for the Eastern District of New York in MDL No. 1720. The plaintiffs have filed a consolidated

class action complaint that seeks treble damages, as well as attorneys’ fees and injunctive relief.

In July 2006, the group of purported merchant class plaintiffs filed a supplemental complaint alleging that MasterCard’s

initial public offering of its Class A Common Stock in May 2006 (the “IPO”) and certain purported agreements entered

into between MasterCard and financial institutions in connection with the IPO: (1) violate U.S. antitrust laws and (2)

constituted a fraudulent conveyance because the financial institutions allegedly attempted to release, without adequate

consideration, MasterCard’s right to assess them for MasterCard's litigation liabilities. In November 2008, the district

court granted MasterCard's motion to dismiss the plaintiffs’ supplemental complaint in its entirety with leave to file an

amended complaint. The class plaintiffs repled their complaint. The causes of action and claims for relief in the

complaint generally mirror those in the plaintiffs' original IPO-related complaint although the plaintiffs have attempted

to expand their factual allegations based upon discovery that has been garnered in the case. The class plaintiffs seek

treble damages and injunctive relief including, but not limited to, an order reversing and unwinding the IPO. In July

2009, the class plaintiffs and individual plaintiffs served confidential expert reports detailing the plaintiffs’ theories of

liability and alleging damages in the tens of billions of dollars. The defendants served their expert reports in December

2009 rebutting the plaintiffs’ assertions both with respect to liability and damages.

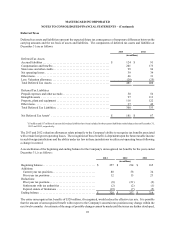

In February 2011, MasterCard and MasterCard International Incorporated entered into each of: (1) an omnibus judgment

sharing and settlement sharing agreement with Visa Inc., Visa U.S.A. Inc. and Visa International Service Association

and a number of financial institutions; and (2) a MasterCard settlement and judgment sharing agreement with a number

of financial institutions. The agreements provide for the apportionment of certain costs and liabilities which MasterCard,

the Visa parties and the financial institutions may incur, jointly and/or severally, in the event of an adverse judgment

or settlement of one or all of the cases in the merchant litigations. Among a number of scenarios addressed by the

agreements, in the event of a global settlement involving the Visa parties, the financial institutions and MasterCard,

MasterCard would pay 12% of the monetary portion of the settlement. In the event of a settlement involving only

MasterCard and the financial institutions with respect to their issuance of MasterCard cards, MasterCard would pay

36% of the monetary portion of such settlement.