MasterCard 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Off-Balance Sheet Arrangements

MasterCard has no off-balance sheet debt, other than lease arrangements and other commitments as presented in the

Future Obligations table that follows.

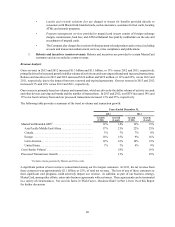

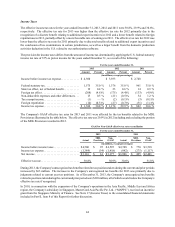

Future Obligations

The following table summarizes our obligations as of December 31, 2013 that are expected to impact liquidity and

cash flow in future periods. We believe we will be able to fund these obligations through cash generated from operations

and our cash balances.

Payments Due by Period

Total 2014 2015 - 2016 2017 - 2018 2019 and

thereafter

(in millions)

Capital leases 1. . . . . . . . . . . . . . . . . . . . . . $ 9 $ 8 $ 1 $ — $ —

Operating leases . . . . . . . . . . . . . . . . . . . . . 125 24 48 29 24

Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 35 — — —

Other long-term obligations 2. . . . . . . . . . .

Sponsorship, licensing and other 3. . . . . . 600 347 198 34 21

Employee benefits 4 . . . . . . . . . . . . . . . . . 95 13 11 16 55

Total 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 864 $ 427 $ 258 $ 79 $ 100

1 The capital lease for the global technology and operations center located in O’Fallon, Missouri has been excluded from this table, since the

Company holds refunding revenue bonds equal to the payments due on the lease. See Note 7 (Property, Plant and Equipment) included in

Part II, Item 8 of this Report for further information.

2 The table does not include the $886 million provision as of December 31, 2013 related to the merchant opt outs and the U.S. merchant class

litigation since the opt outs are not fixed and determinable and the Company has made a payment into escrow to fund the U.S. merchant

class litigation or has a corresponding equal amount presented in settlement due from customers. See Note 18 (Legal and Regulatory

Proceedings) to the consolidated financial statements included in Part II, Item 8 of this Report for further discussion.

3 Amounts primarily relate to sponsorships to promote the MasterCard brand. Future cash payments that will become due to our customers

under agreements which provide pricing rebates on our standard fees and other incentives in exchange for transaction volumes are not

included in the table because the amounts due are contingent on future performance. MasterCard has accrued $1.5 billion as of December

31, 2013 related to customer and merchant agreements.

4 Amounts relate to committed, unfunded postemployment benefits and minimum funding requirements for defined benefit plans.

5 The Company has recorded a liability for unrecognized tax benefits of $320 million at December 31, 2013 and estimates that approximately

$1 million of this liability is expected to be settled within the next 12 months. These amounts have been excluded from the table since the

settlement period for the non-current portion of this liability cannot be reasonably estimated. The timing of these payments will ultimately

depend on the progress of tax examinations with the various authorities.

Seasonality

The Company does not experience meaningful seasonality. No individual quarter in 2013, 2012 or 2011 accounted for

more than 30% of net revenue.

Critical Accounting Estimates

The application of U.S. GAAP requires the Company to make estimates and assumptions about certain items and future

events that directly affect the Company's reported financial condition. We have established detailed policies and control

procedures to provide reasonable assurance that the methods used to make estimates and assumptions are well controlled

and are applied consistently from period to period. The accounting estimates and assumptions discussed in this section

are those that the Company considers to be the most critical to its financial statements. An accounting estimate is

considered critical if both (a) the nature of the estimate or assumption is material due to the levels of subjectivity and

judgment involved, and (b) the impact within a reasonable range of outcomes of the estimate and assumption is material

to the Company's financial condition. Senior management has discussed the development, selection and disclosure of

these estimates with the Audit Committee of the Company's Board of Directors. The Company's significant accounting

policies, including recent accounting pronouncements, are described in Note 1 (Summary of Significant Accounting

Policies) to the consolidated financial statements included in Part II, Item 8 of this Report.