MasterCard 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

77

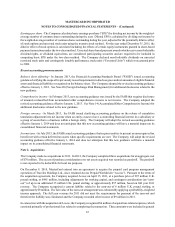

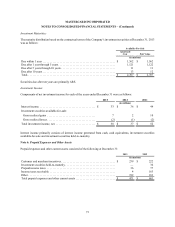

Note 11. Pension Plans, Postretirement Plans, Savings Plans and Other Benefits

The Company maintains various pension, postretirement, savings and other postemployment benefit plans that cover

substantially all employees worldwide.

U.S. employees hired before July 1, 2007 participate in a non-contributory, qualified, defined benefit pension plan (the

“Qualified Plan”) with a cash balance feature. In 2010, the Company amended the Qualified Plan to phase out participant

pay credit percentages in the years 2011 and 2012 and eliminate the pay credit effective January 1, 2013. Plan participants

continue to earn interest credits. In 2013, the Company recorded a $2 million partial settlement charge from lump sum

distribution activity in the Qualified Plan. The Company also recognized corresponding effects in accumulated other

comprehensive income and deferred taxes.

The Company also has an unfunded non-qualified supplemental executive retirement plan (the “Non-qualified Plan”)

that provides certain key employees with supplemental retirement benefits in excess of limits imposed on qualified

plans by U.S. tax laws. The Non-qualified Plan had settlement gains in 2011 resulting from payments to participants.

Internationally-based employees of the Company participate in plans that cover various pension and postemployment

benefits specific to their country of employment. These benefits are incorporated into the disclosures below as they

are not a material component of the total benefit obligations, fair value of plan assets, or plan funded status. Prior

period amounts have been revised to conform to this presentation. The term “Pension Plans” includes the Qualified

Plan, the Non-qualified Plan and these international defined benefit pension plans.

The Company maintains a postretirement plan providing health coverage and life insurance benefits for substantially

all of its U.S. employees hired before July 1, 2007. The U.S. postretirement plan and the various international

postemployment benefit plans are collectively referred to as the “Postretirement Plans”.