MasterCard 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

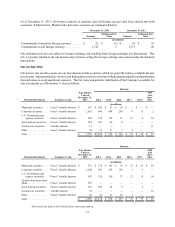

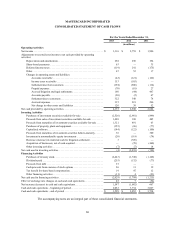

As of December 31, 2013, all forward contracts to purchase and sell foreign currency had been entered into with

customers of MasterCard. MasterCard’s derivative contracts are summarized below:

December 31, 2013 December 31, 2012

Notional Estimated Fair

Value Notional Estimated Fair

Value

(in millions)

Commitments to purchase foreign currency . . . . . . . $ 23 $ (1) $ 76 $ (1)

Commitments to sell foreign currency. . . . . . . . . . . . 1,722 1 1,571 (2)

Our settlement activities are subject to foreign exchange risk resulting from foreign exchange rate fluctuations. This

risk is typically limited to the one business day between setting the foreign exchange rates and clearing the financial

transactions.

Interest Rate Risk

Our interest rate sensitive assets are our investments in debt securities, which we generally hold as available-for-sale

investments. Our general policy is to invest in high quality securities, while providing adequate liquidity and maintaining

diversification to avoid significant exposure. The fair value and maturity distribution of the Company's available for

sale investments as of December 31 was as follows:

Maturity

Fair Market

Value at

December 31,

2013

2019

and

there-

after

Financial Instrument Summary Terms 2014 2015 2016 2017 2018

(in millions)

Municipal securities . . . . Fixed / Variable Interest $ 267 $ 200 $ 57 $ 10 $ — $ — $ —

Corporate securities . . . . Fixed / Variable Interest 1,426 646 464 290 9 15 2

U.S. Government and

Agency securities . . . Fixed / Variable Interest 560 376 122 31 12 9 10

Asset-backed securities. . Fixed / Variable Interest 364 307 49 8 — — —

Auction rate securities . . Variable Interest 11 — — — — — 11

Other . . . . . . . . . . . . . . . . Fixed / Variable Interest 79 33 37 7 2 — —

Total . . . . . . . . . . . . . . . . $ 2,707 $1,562 $ 729 $ 346 $ 23 $ 24 $ 23

Maturity

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2012 2013 2014 2015 2016 2017

2018

and

there-

after

(in millions)

Municipal securities . . . . Fixed / Variable Interest $ 531 $ 174 $ 136 $ 78 $ 55 $ 38 $ 50

Corporate securities . . . . Fixed / Variable Interest 1,246 607 470 159 1 9 —

U.S. Government and

Agency securities . . . Fixed / Variable Interest 582 355 150 37 22 8 10

Taxable short-term bond

funds . . . . . . . . . . . . . . . . Fixed / Variable Interest 210 — — — — — —

Asset-backed securities. . Fixed / Variable Interest 316 259 45 8 — 4 —

Auction rate securities . . Variable Interest 32 — — — — — 32

Other . . . . . . . . . . . . . . . . Fixed / Variable Interest 66 23 27 15 1 — —

Total . . . . . . . . . . . . . . . . $ 2,983 $1,418 $ 828 $ 297 $ 79 $ 59 $ 92

1 Short-term bond funds of $210 million had no contractual maturity.