MasterCard 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

90

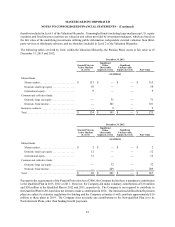

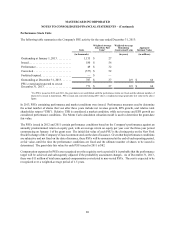

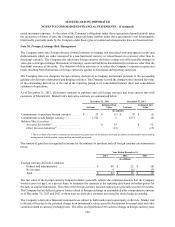

Note 16. Commitments

At December 31, 2013, the Company had the following future minimum payments due under non-cancelable

agreements:

Total Capital

Leases Operating

Leases

Sponsorship,

Licensing &

Other

(in millions)

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 379 $ 8 $ 24 $ 347

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163 1 25 137

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84 — 23 61

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41 — 18 23

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 — 11 11

Thereafter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 — 24 21

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 734 $ 9 $ 125 $ 600

Included in the table above are capital leases with a net present value of minimum lease payments of $9 million. In

addition, at December 31, 2013, $46 million of the future minimum payments in the table above for operating leases,

sponsorship, licensing and other agreements was accrued. Consolidated rental expense for the Company’s leased office

space was $38 million, $36 million and $30 million for the years ended December 31, 2013, 2012 and 2011, respectively.

Consolidated lease expense for automobiles, computer equipment and office equipment was $14 million, $11 million

and $9 million for the years ended December 31, 2013, 2012 and 2011, respectively.

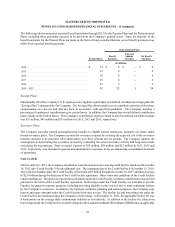

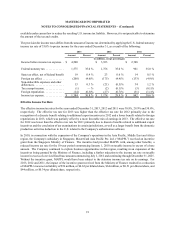

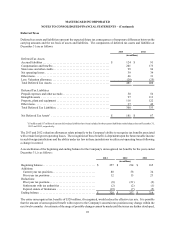

Note 17. Income Taxes

The total income tax provision for the years ended December 31 is comprised of the following components:

2013 2012 2011

(in millions)

Current

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,010 $ 524 $ 619

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 24 30

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 456 390 369

1,499 938 1,018

Deferred

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (100) 248 (155)

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4) 7 (6)

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11) (19) (15)

(115) 236 (176)

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,384 $ 1,174 $ 842

The domestic and foreign components of income before income taxes for the years ended December 31 are as follows:

2013 2012 2011

(in millions)

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,741 $ 2,508 $ 1,415

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,759 1,425 1,333

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,500 $ 3,933 $ 2,748

MasterCard has not provided for U.S. federal income and foreign withholding taxes on approximately $3.5 billion of

undistributed earnings from non-U.S. subsidiaries as of December 31, 2013 because such earnings are intended to be

reinvested indefinitely outside of the United States. If these earnings were distributed, foreign tax credits may become