MasterCard 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Net cash used in investing activities for the year ended December 31, 2013 was primarily related to purchases of

investment securities and increased property, plant and equipment and capitalized software, partially offset by net

proceeds from sales and maturities of investment securities. Net cash used in investing activities for the year ended

December 31, 2012 was primarily related to purchases of investment securities and the payment related to U.S. merchant

class litigations into escrow, partially offset by net proceeds from sales and maturities of investment securities.

Net cash used in financing activities for the years ended December 31, 2013 and 2012 was primarily related to the

repurchase of the Company’s Class A common stock and dividend payments to our stockholders.

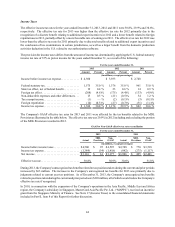

The table below shows a summary of the balance sheet data at December 31:

2013 2012 2011

(in millions)

Balance Sheet Data:

Current assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,950 $ 9,357 $ 7,741

Current liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,032 4,906 4,217

Long-term liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 715 627 599

Equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,495 6,929 5,877

The Company believes that its existing cash, cash equivalents and investment securities balances, its cash flow generating

capabilities, its borrowing capacity and its access to capital resources are sufficient to satisfy its future operating cash

needs, capital asset purchases, outstanding commitments and other liquidity requirements associated with its existing

operations and potential obligations.

Credit Availability

On November 16, 2013, the Company extended its committed unsecured revolving credit facility, dated as of November

16, 2012 (the “Credit Facility”), for an additional year. The expiration date of the Credit Facility is November 15,

2018. The available funding under the Credit Facility will remain at $3 billion through November 16, 2017 and then

decrease to $2.95 billion during the final year of the Credit Facility agreement. Other terms and conditions of the Credit

Facility remain unchanged. The option to request that each lender under the Credit Facility extend its commitment

was provided pursuant to the terms of the Credit Facility agreement. Borrowings under the Credit Facility are available

to provide liquidity for general corporate purposes, including providing liquidity in the event of one or more settlement

failures by the Company's customers. In addition, for business continuity planning and related purposes, the Company

may borrow and repay amounts under the Credit Facility from time to time. The facility fee and borrowing cost under

the Credit Facility are contingent upon the Company's credit rating. At December 31, 2013, the applicable facility fee

was 8 basis points on the average daily commitment (whether or not utilized). In addition to the facility fee, interest

on borrowings under the Credit Facility would be charged at the London Interbank Offered Rate (LIBOR) plus an

applicable margin of 79.5 basis points, or an alternative base rate. MasterCard had no borrowings under the Credit

Facility at December 31, 2013 and 2012.

The Credit Facility contains customary representations, warranties, events of default and affirmative and negative

covenants, including a financial covenant limiting the maximum level of consolidated debt to earnings before interest,

taxes, depreciation and amortization. MasterCard was in compliance in all material respects with the covenants of the

Credit Facility at December 31, 2013 and 2012. The majority of Credit Facility lenders are customers or affiliates of

customers of MasterCard.

On August 2, 2012, the Company filed a universal shelf registration statement to provide additional access to capital,

if needed. Pursuant to the shelf registration statement, the Company may from time to time offer to sell debt securities,

preferred stock, Class A common stock, depository shares, purchase contracts, units or warrants in one or more offerings.