MasterCard 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

69

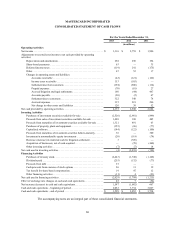

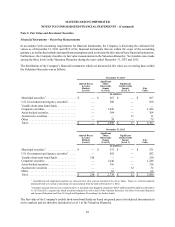

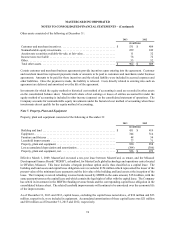

Note 5. Fair Value and Investment Securities

Financial Instruments – Recurring Measurements

In accordance with accounting requirements for financial instruments, the Company is disclosing the estimated fair

values as of December 31, 2013 and 2012 of the financial instruments that are within the scope of the accounting

guidance, as well as the methods and significant assumptions used to estimate the fair value of those financial instruments.

Furthermore, the Company classifies its fair value measurements in the Valuation Hierarchy. No transfers were made

among the three levels in the Valuation Hierarchy during the years ended December 31, 2013 and 2012.

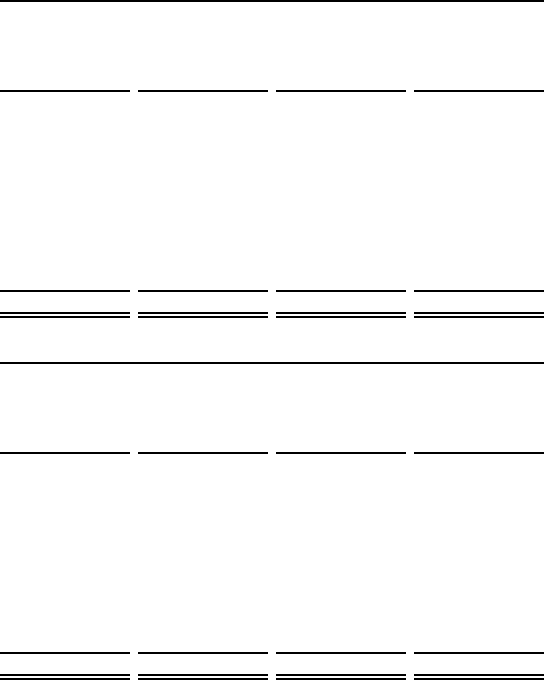

The distribution of the Company’s financial instruments which are measured at fair value on a recurring basis within

the Valuation Hierarchy was as follows:

December 31, 2013

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Fair

Value

(in millions)

Municipal securities1. . . . . . . . . . . . . . . . . . . . . $ — $ 267 $ — $ 267

U.S. Government and Agency securities2. . . . . — 560 — 560

Taxable short-term bond funds . . . . . . . . . . . . . — — — —

Corporate securities . . . . . . . . . . . . . . . . . . . . . . — 1,426 — 1,426

Asset-backed securities . . . . . . . . . . . . . . . . . . . — 364 — 364

Auction rate securities . . . . . . . . . . . . . . . . . . . . — — 11 11

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 79 — 79

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 2,696 $ 11 $ 2,707

December 31, 2012

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Fair

Value

(in millions)

Municipal securities1. . . . . . . . . . . . . . . . . . . . . $ — $ 531 $ — $ 531

U.S. Government and Agency securities2. . . . . — 582 — 582

Taxable short-term bond funds . . . . . . . . . . . . . 210 — — 210

Corporate securities . . . . . . . . . . . . . . . . . . . . . . — 1,246 — 1,246

Asset-backed securities . . . . . . . . . . . . . . . . . . . — 316 — 316

Auction rate securities . . . . . . . . . . . . . . . . . . . . — — 32 32

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 63 — 63

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 210 $ 2,738 $ 32 $ 2,980

1 Available-for-sale municipal securities are carried at fair value and are included in the above tables. However, a held-to-maturity

municipal bond was carried at amortized cost and excluded from the table at December 31, 2012.

2 Excludes amounts held in escrow related to the U.S. merchant class litigation settlement of $723 million and $726 million at December

31, 2013 and 2012, respectively, which would be included in Levels 1 and 2 of the Valuation Hierarchy. See Note 10 (Accrued Expenses

and Accrued Litigation) and Note 18 (Legal and Regulatory Proceedings) for further details.

The fair value of the Company's taxable short-term bond funds are based on quoted prices for identical investments in

active markets and are therefore included in Level 1 of the Valuation Hierarchy.