MasterCard 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

• Loyalty and rewards solutions fees are charged to issuers for benefits provided directly to

consumers with MasterCard-branded cards, such as insurance, assistance for lost cards, locating

ATMs and rewards programs.

• Program management services provided to prepaid card issuers consist of foreign exchange

margin, commissions, load fees, and ATM withdrawal fees paid by cardholders on the sale and

encashment of prepaid cards.

• The Company also charges for a variety of other payment-related products and services, including

account and transaction enhancement services, rules compliance and publications.

5. Rebates and incentives (contra-revenue): Rebates and incentives are provided to certain MasterCard

customers and are recorded as contra-revenue.

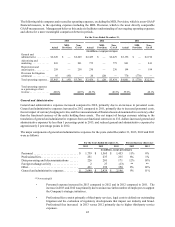

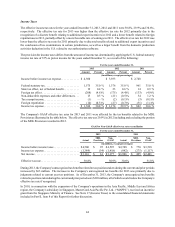

Revenue Analysis

Gross revenue in 2013 and 2012 increased $1.3 billion and $1.1 billion, or 13% versus 2012 and 2011, respectively,

primarily driven by increased growth in dollar volume of activity on cards carrying our brands and increased transactions.

Rebates and incentives in 2013 and 2012 increased $326 million and $472 million, or 12% and 22%, versus 2012 and

2011, respectively, due to the impact from new, renewed and expired agreements. Our net revenue in 2013 and 2012

increased 13% and 10% versus 2012 and 2011, respectively.

Our revenue is primarily based on volumes and transactions, which are driven by the dollar volume of activity on cards

and other devices carrying our brands and the number of transactions. In 2013 and 2012, our GDV increased 14% and

15% on a local currency basis and our processed transactions increased 13% and 25%, respectively.

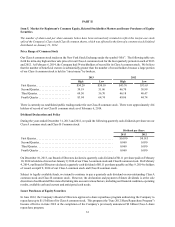

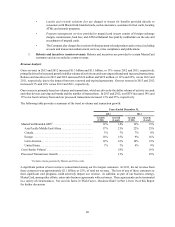

The following table provides a summary of the trend in volume and transaction growth:

Years Ended December 31,

2013 2012

Growth

(USD) Growth

(Local) Growth

(USD) Growth

(Local)

MasterCard Branded GDV1. . . . . . . . . . . . . . . . . . . . . . . . . . . . 12% 14% 12% 15%

Asia Pacific/Middle East/Africa . . . . . . . . . . . . . . . . . . . . . . 17% 21% 22% 23%

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3% 7% 7% 8%

Europe. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16% 15% 9% 16%

Latin America . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12% 16% 10% 19%

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7% 7% 9% 9%

Cross-border Volume1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18% 16%

Processed Transactions Growth. . . . . . . . . . . . . . . . . . . . . . . . . 13% 25%

1 Excludes volume generated by Maestro and Cirrus cards.

A significant portion of our revenue is concentrated among our five largest customers. In 2013, the net revenue from

these customers was approximately $2.1 billion, or 25%, of total net revenue. The loss of any of these customers or

their significant card programs could adversely impact our revenue. In addition, as part of our business strategy,

MasterCard, among other efforts, enters into business agreements with customers. These agreements can be terminated

in a variety of circumstances. See our risk factor in "Risk Factor - Business Risks" in Part I, Item 1A of this Report

for further discussion.