MasterCard 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

93

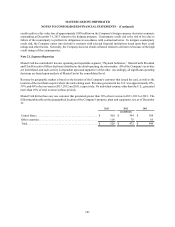

the examinations close or the statutes expire. The Company is subject to tax in the United States, Belgium, Singapore

and various other foreign jurisdictions, as well as state and local jurisdictions. The Company has effectively settled its

U.S. federal income tax obligations through 2008. With limited exception, the Company is no longer subject to state

and local or foreign examinations by tax authorities for years before 2002.

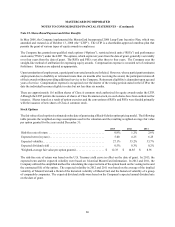

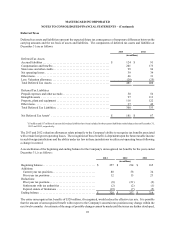

It is the Company's policy to account for interest expense related to income tax matters as interest expense in its statement

of operations, and to include penalties related to income tax matters in the income tax provision. For the years ended

December 31, 2013, 2012 and 2011, the Company recorded tax-related interest income of $4 million, $1 million and

$2 million, respectively, in its consolidated statement of operations. At December 31, 2013 and 2012 the Company

had a net income tax-related interest payable of $17 million and $15 million, respectively, in its consolidated balance

sheet. At December 31, 2013 and 2012, the amounts the Company had recognized for penalties payable in its

consolidated balance sheet were not significant.

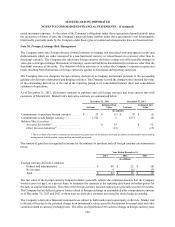

Note 18. Legal and Regulatory Proceedings

MasterCard is a party to legal and regulatory proceedings with respect to a variety of matters in the ordinary course of

business. Some of these proceedings are based on complex claims involving substantial uncertainties and

unascertainable damages. Accordingly, except as discussed below, it is not possible to determine the probability of

loss or estimate damages, and therefore, except as discussed below, MasterCard has not established reserves for any

of these proceedings. Except as identified below, MasterCard does not believe that the outcome of any existing legal

or regulatory proceedings to which it is a party will have a material adverse effect on its results of operations, financial

condition or overall business. However, with respect to the matters discussed below, an adverse judgment or other

outcome or settlement with respect to any such proceedings could result in fines or payments by MasterCard and/or

could require MasterCard to change its business practices. In addition, an adverse outcome in a regulatory proceeding

could lead to the filing of civil damage claims and possibly result in damage awards in amounts that could be significant.

Any of these events could have a material adverse effect on MasterCard’s results of operations, financial condition and

overall business.

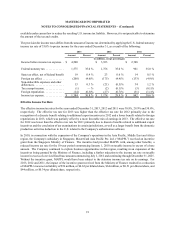

Department of Justice Antitrust Litigation and Related Private Litigations

In April 2005, a complaint was filed in California state court on behalf of a putative class of consumers under California

unfair competition law (Section 17200) and the Cartwright Act (the “Attridge action”). The claims in this action seek

to leverage a 1998 action by the U.S. Department of Justice against MasterCard International, Visa U.S.A., Inc. and

Visa International Corp. In that action, a federal district court concluded that both MasterCard’s Competitive Programs

Policy and a Visa bylaw provision that prohibited financial institutions participating in the respective associations from

issuing competing proprietary payment cards (such as American Express or Discover) constituted unlawful restraints

of trade under the federal antitrust laws. The state court in the Attridge action granted the defendants' motion to dismiss

the plaintiffs’ state antitrust claims but denied the defendants' motion to dismiss the plaintiffs' Section 17200 unfair

competition claims. In September 2009, MasterCard executed a settlement agreement that is subject to court approval

in the separate California consumer litigations (see “U.S. Merchant and Consumer Litigations”). The agreement includes

a release that the parties believe encompasses the claims asserted in the Attridge action. In August 2010, the Court in

the California consumer actions granted final approval to the settlement. The plaintiff from the Attridge action and

three other objectors filed appeals of the settlement approval. In January 2012, the Appellate Court reversed the trial

court's settlement approval and remanded the matter to the trial court for further proceedings. In August 2012, the

parties in the California consumer actions filed a motion seeking approval of a revised settlement agreement. The trial

court granted final approval of the settlement in April 2013, to which the objectors have appealed.

U.S. Merchant and Consumer Litigations

Commencing in October 1996, several class action suits were brought by a number of U.S. merchants against MasterCard

International and Visa U.S.A., Inc. challenging certain aspects of the payment card industry under U.S. federal antitrust

law. The plaintiffs claimed that MasterCard's “Honor All Cards” rule (and a similar Visa rule), which required merchants

who accept MasterCard cards to accept for payment every validly presented MasterCard card, constituted an illegal