MasterCard 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

85

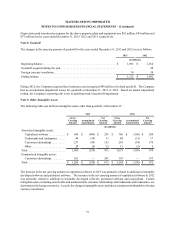

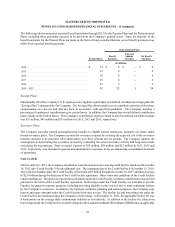

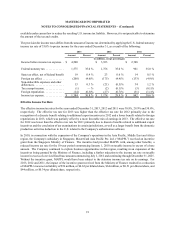

The following table summarizes the Company's share repurchase authorizations of its Class A common stock through

December 31, 2013, as well as historical purchases:

Authorization Dates

December

2013 February

2013 June

2012 April

20111Total

(in millions, except average price data)

Board authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,500 $ 2,000 $ 1,500 $ 2,000 $ 9,000

Dollar-value of shares repurchased in 2011. . . . . . . . . . ** ** ** $ 1,148 $ 1,148

Remaining authorization at December 31, 2011 . . . . . . ** ** ** $ 852 $ 852

Dollar-value of shares repurchased in 2012. . . . . . . . . . ** ** $ 896 $ 852 $ 1,748

Remaining authorization at December 31, 2012 . . . . . . ** ** $ 604 $ — $ 604

Dollar-value of shares repurchased in 2013. . . . . . . . . . $ — $ 1,839 $ 604 $ — $ 2,443

Remaining authorization at December 31, 2013 . . . . . . $ 3,500 $ 161 $ — $ — $ 3,661

Shares repurchased in 2011 . . . . . . . . . . . . . . . . . . . . . . ** ** ** 44.3 44.3

Average price paid per share in 2011. . . . . . . . . . . . . . . ** ** ** $ 25.89 $ 25.89

Shares repurchased in 2012 . . . . . . . . . . . . . . . . . . . . . . ** ** 19.5 21.1 40.6

Average price paid per share in 2012. . . . . . . . . . . . . . . ** ** $ 46.02 $ 40.35 $ 43.07

Shares repurchased in 2013 . . . . . . . . . . . . . . . . . . . . . . — 29.2 11.7 — 40.9

Average price paid per share in 2013. . . . . . . . . . . . . . . $ — $ 63.01 $ 51.72 $ — $ 59.78

Cumulative shares repurchased through

December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 29.2 31.1 65.4 125.7

Cumulative average price paid per share . . . . . . . . . . . . $ — $ 63.01 $ 48.16 $ 30.56 $ 42.45

** Not applicable

1 The initial authorization in September 2010 for $1 billion was amended in April 2011 to increase the authorization to $2 billion.

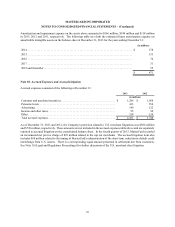

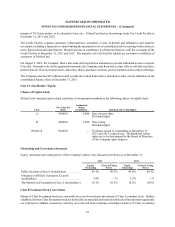

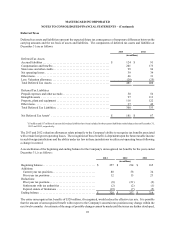

Note 14. Accumulated Other Comprehensive Income (Loss)

The changes in the balances of each component of accumulated other comprehensive income (loss) for the years ended

December 31, 2013 and 2012 were as follows:

Foreign

Currency

Translation

Adjustments

Defined Benefit

Pension and

Other

Postretirement

Plans, Net of Tax

Investment

Securities

Available-for-

Sale, Net of Tax

Accumulated

Other

Comprehensive

Income (Loss)

(in millions)

Balance at December 31, 2011. . . . . . . . . . . . . . . . . . . . $ 30 $ (32) $ — $ (2)

Current period other comprehensive income (loss) *. . . 63 (5) 5 63

Balance at December 31, 2012. . . . . . . . . . . . . . . . . . . . 93 (37) 5 61

Current period other comprehensive income (loss) *. . . 113 8 (4) 117

Balance at December 31, 2013. . . . . . . . . . . . . . . . . . . . $ 206 $ (29) $ 1 $ 178

* During the years ended December 31, 2013 and 2012, $6 million and $13 million of deferred costs related to the Company's Pension

Plans and Postretirement Plans were reclassified from accumulated other comprehensive income to general and administrative expense.

In addition, $5 million and $1 million of net gains on available-for-sale investment securities were recognized in investment income

during the years ended December 31, 2013 and 2012, respectively. Tax amounts related to these items are insignificant.