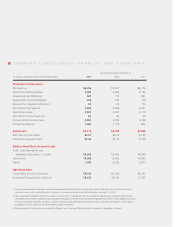

MasterCard 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

We generate revenue by charging fees to issuers and acquirers for providing transaction processing and other payment-

related products and services, as well as by assessing these customers based, primarily, on the dollar volume of activity,

or gross dollar volume (“GDV”), on the cards and other devices that carry our brands.

MasterCard operates in a dynamic and rapidly evolving legal and regulatory environment with heightened regulatory

and legislative scrutiny and other legal challenges, particularly with respect to interchange fees. See “Risk Factors-

Legal and Regulatory Risks” in Part I, Item 1A of this Report.

Payment Services and Solutions

We provide transaction processing and a wide range of payment-related products and services to enable the design,

packaging and implementation of our products and programs. Our payment solutions are built upon our expertise in

payment programs, product development, payment processing technology, loyalty and rewards solutions, payment

security, consulting and information services and marketing.

Our Operations and Transaction Processing Network

Introduction. We operate the MasterCard Network, our unique and proprietary global payments network that links

issuers and acquirers around the globe to facilitate the processing of transactions, permitting MasterCard cardholders

to use their cards and other payment devices at millions of merchants worldwide. Our network facilitates an efficient

and secure means for merchants to receive payments, and a convenient, quick and secure payment method for consumers

and businesses that is accepted worldwide. We process transactions through our network for our issuer customers in

more than 150 currencies in more than 210 countries and territories.

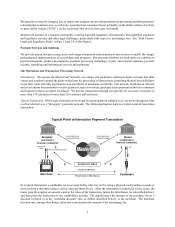

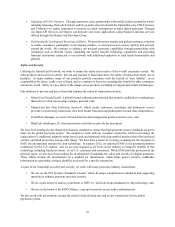

Typical Transaction. With a typical transaction involving four participants in addition to us, our network supports what

is often referred to as a “four-party” payments network. The following diagram depicts a typical point-of-interaction

transaction:

In a typical transaction, a cardholder (or an account holder who may not be using a physical card) purchases goods or

services from a merchant using a card or other payment device. After the transaction is authorized by the issuer, the

issuer pays the acquirer an amount equal to the value of the transaction, minus the interchange fee (described below),

and then posts the transaction to the cardholder's account. The acquirer pays the amount of the purchase, net of a

discount (referred to as the “merchant discount” rate, as further described below), to the merchant. The merchant

discount rate, among other things, takes into consideration the amount of the interchange fee.

Typical Point of Interaction Payment Transaction

Acquirer

(merchant’s

financial institution

)

Transaction

Data

Issuer

(cardholder’s

financial institution)

$

Bill

$

(less merchant discount)

Settlement Bank

Merchant Cardholder

$$

Present Card or Other Device

Goods and Services

Authorization and

Transaction Data

Authorization and

Transaction Data