MasterCard 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

84

stock. Class B stockholders are required to subsequently sell or otherwise transfer any shares of Class A common stock

received pursuant to such a conversion.

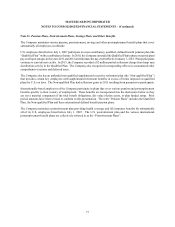

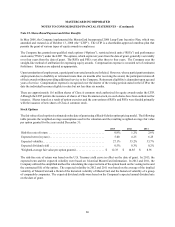

The MasterCard Foundation

In connection and simultaneously with its 2006 initial public offering (the "IPO"), the Company issued and donated

135 million newly authorized shares of Class A common stock to The MasterCard Foundation (the “Foundation”). The

Foundation is a private charitable foundation incorporated in Canada that is controlled by directors who are independent

of the Company and its principal customers. Under the terms of the donation, the Foundation became able to resell

the donated shares in May 2010 and to the extent necessary to meet charitable disbursement requirements dictated by

Canadian tax law. Under Canadian tax law, the Foundation is generally required to disburse at least 3.5% of its assets

not used in administration each year for qualified charitable disbursements. However, the Foundation obtained

permission from the Canadian tax authorities to defer the giving requirements for up to ten years, which was extended

in 2011 to 15 years. The Foundation, at its discretion, may decide to meet its disbursement obligations on an annual

basis or to settle previously accumulated obligations during any given year. The Foundation will be permitted to sell

all of its remaining shares beginning twenty years and eleven months after the consummation of the IPO.

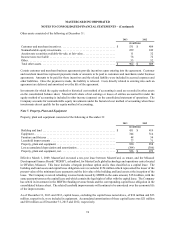

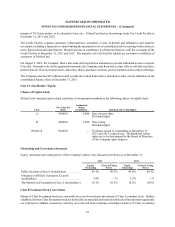

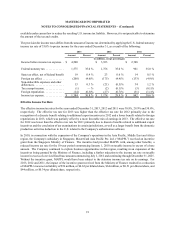

Stock Repurchase Programs

In June 2012, the Company’s Board of Directors approved a share repurchase program authorizing the Company to

repurchase up to $1.5 billion of its Class A common stock (the "June 2012 Share Repurchase Program"). This program

became effective in June 2012 at the completion of the Company’s previously announced $2 billion Class A share

repurchase program. (This $2 billion repurchase program consisted of $1 billion authorized in September 2010 and

$1 billion authorized in April 2011.)

On February 5, 2013, the Company's Board of Directors approved a share repurchase program authorizing the Company

to repurchase up to $2 billion of its Class A common stock (the "February 2013 Share Repurchase Program"). This

program became effective at the completion of the Company's June 2012 Share Repurchase Program, which occurred

in March 2013.

On December 10, 2013, the Company's Board of Directors approved a new share repurchase program authorizing the

Company to repurchase up to $3.5 billion of its Class A common stock (the "December 2013 Share Repurchase

Program"). During January 2014, the Company exhausted its purchases under the February 2013 Share Repurchase

Program and began purchasing shares under the December 2013 Share Repurchase Program. As of January 24, 2014,

the cumulative repurchases by the Company under both the February 2013 Share Repurchase Program and December

2013 Share Repurchase Program in 2014 totaled approximately 4.2 million shares of Class A common stock for an

aggregate cost of approximately $351 million, at an average price of $83.00 per share of Class A common stock. As

of January 24, 2014, the Company had approximately $3.3 billion remaining under the December 2013 Share Repurchase

Program.