MasterCard 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Please see a complete discussion of these risk factors in Part I, Item 1A - Risk Factors. We caution you that the important

factors referenced above may not contain all of the factors that are important to you. Our forward-looking statements

speak only as of the date of this report or as of the date they are made, and we undertake no obligation to update our

forward-looking statements.

Item 1. Business

Overview

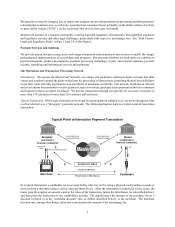

MasterCard is a technology company in the global payments industry that connects consumers, financial institutions,

merchants, governments and businesses worldwide, enabling them to use electronic forms of payment instead of cash

and checks. As the operator of the world’s fastest payments network, we facilitate the processing of payment transactions,

including authorization, clearing and settlement, and deliver related products and services. We make payments easier

and more efficient by creating a wide range of payment solutions and services using our family of well-known brands,

including MasterCard®, Maestro® and Cirrus®. We also provide value-added offerings such as loyalty and reward

programs, information services and consulting. Our network is designed to ensure safety and security for the global

payments system. A typical transaction on our network involves four participants in addition to us: cardholder, merchant,

issuer (the cardholder’s financial institution) and acquirer (the merchant’s financial institution). We do not issue cards,

extend credit, determine or receive revenue from interest rates or other fees charged to cardholders by issuers, or

establish the “merchant discount” rate charged in connection with the acceptance of cards and other payment devices

that carry our brands. In most cases, cardholder relationships belong to, and are managed by, our financial institution

customers.

Our ability to grow is influenced by personal consumption expenditure growth, driving paper-based forms of payment

toward electronic forms of payment and increasing our share in electronic payments and providing other value-added

products and services. We continue to drive growth by:

• Growing our core businesses globally, both as to our products - credit, debit, prepaid and commercial - and

increasing the number of payment transactions we process;

• Diversifying our business by seeking new areas of growth in markets around the world by focusing on:

Existing and new markets;

Encouraging consumers and businesses to use MasterCard products for new payment areas, such as

transit, parking, person-to-person transfers and paying bills;

Small merchants and merchants who have not historically accepted MasterCard products; and

Financial inclusion for the unbanked and underbanked; and

• Building our business by:

taking advantage of the opportunities presented by the ongoing convergence of the physical and

digital worlds; and

using our data analytics, loyalty solutions and fraud protection and detection services to add value.

Our technology, expertise and data make payments safe, simple and fast. We work with merchants to help them enable

new sales channels, create better purchase experiences, increase revenues and fight fraud. We help national, state and

local governments drive increased financial inclusion and efficiency, reduce costs, increase transparency to reduce

crime and corruption and advance social programs. For consumers, we provide better, safer and more convenient ways

to pay. We provide financial institutions with solutions to help them increase revenue and increase preference for their

MasterCard-branded products.