MasterCard 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

Rapid technological developments in our industry present both operational and legal challenges (including

potential intellectual property exposure) which could impact our results of operations or limit our future growth.

The payments industry is subject to rapid and significant technological changes, including continuing developments

of technologies in the areas of smart cards and devices, radio frequency and proximity payment devices (such as

contactless payment devices), electronic commerce and mobile commerce, among others. We cannot predict the effect

of technological changes on our business. We rely in part on third parties, including some of our competitors and

potential competitors, for the development of and access to new technologies. We expect that new services and

technologies applicable to the payments industry will continue to emerge, and these new services and technologies

may be superior to, or render obsolete, the technologies we currently use in our programs and services. In addition,

our ability to adopt new services and technologies that we develop may be inhibited by a need for industry-wide

standards and by resistance from customers or merchants to such changes by the complexity of our systems. Our ability

to adopt these technologies can also be inhibited by intellectual property rights of third parties. We have received, and

we may in the future receive, notices or inquiries from patent holders (for example, other operating companies or non-

practicing entities) suggesting that we may be infringing certain patents or that we need to license the use of their patents

to avoid infringement. Such notices may, among other things, threaten litigation against us or our customers or demand

significant license fees. Our future success will depend, in part, on our ability to develop or adapt to technological

changes and evolving industry standards. Failure to keep pace with these technological developments could lead to a

decline in the use of our products, which could have a material adverse impact on our results of operations.

Adverse currency fluctuations and foreign exchange controls could negatively impact our results of operations.

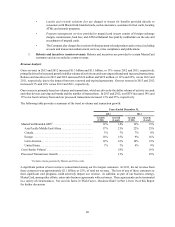

During 2013, approximately 61% of our revenue was generated from activities outside the United States. This revenue

(and the related expense) could be transacted in a non-functional currency or valued based on a currency other than

the functional currency of the entity generating the revenues. Resulting exchange gains and losses are included in our

net income. Our risk management activities provide protection with respect to adverse changes in the value of only a

limited number of currencies and are based on estimates of exposures to these currencies.

In addition, some of the revenue we generate outside the United States is subject to unpredictable currency fluctuations

(including devaluations of currencies) where the values of other currencies change relative to the U.S. dollar. If the

U.S. dollar strengthens compared to currencies in which we generate revenue, this revenue may be translated at a

materially lower amount than expected. Furthermore, we may become subject to exchange control regulations that

might restrict or prohibit the conversion of our other revenue currencies into U.S. dollars.

The occurrence of currency fluctuations or exchange controls could have a material adverse impact on our results of

operations.

Acquisitions, strategic investments or entry into new businesses could disrupt our business and harm our results

of operations or reputation.

Although we may continue to make strategic acquisitions of, or acquire interests in joint ventures or other entities

related to, complementary businesses, products or technologies, we may not be able to successfully partner with or

integrate any such acquired businesses, products or technologies. In addition, the integration of any acquisition or

investment (including efforts related to an acquisition of an interest in a joint venture or other entity) may divert

management's time and resources from our core business and disrupt our operations. Moreover, we may spend time

and money on acquisitions or projects that do not meet our expectations or increase our revenue. To the extent we pay

the purchase price of any acquisition in cash, it would reduce our cash reserves available to us for other uses, and to

the extent the purchase price is paid with our stock, it could be dilutive to our stockholders. Furthermore, we may not

be able to successfully finance the business following the acquisition as a result of costs of operations, including any

litigation risk which may be inherited from the acquisition. Any acquisition or entry into a new business could subject

us to new regulations with which we would need to comply, and we could be subject to liability or reputational harm

to the extent we cannot meet any such compliance requirements. Our expansion into new businesses could also result

in unanticipated issues which may be difficult to manage. Although we periodically evaluate potential acquisitions of

businesses, products and technologies and anticipate continuing to make these evaluations, we cannot guarantee that

we will be able to execute and integrate any such acquisitions.