MasterCard 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

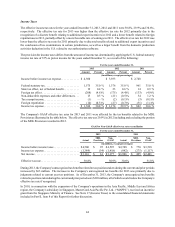

Dividends and Share Repurchases

MasterCard has historically paid quarterly dividends on its outstanding Class A common stock and Class B common

stock. Subject to legally available funds, we intend to continue to pay a quarterly cash dividend. However, the declaration

and payment of future dividends is at the sole discretion of our Board of Directors after taking into account various

factors, including our financial condition, operating results, available cash and current and anticipated cash needs. The

following table summarizes the annual, per share dividends paid in the years reflected:

Years Ended December 31,

2013 2012 2011

(in millions, except per share data)

Cash dividend, per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.210 $ 0.105 $ 0.060

Cash dividends paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 255 $ 132 $ 77

On December 10, 2013, our Board of Directors declared a quarterly cash dividend of $0.11 per share paid on February

10, 2014 to holders of record on January 9, 2014 of our Class A common stock and Class B common stock. The

aggregate amount of this dividend was $131 million.

On February 4, 2014, our Board of Directors declared a quarterly cash dividend of $0.11 per share payable on May 9,

2014 to holders of record on April 9, 2014 of our Class A common stock and Class B common stock. The aggregate

amount of this dividend is estimated to be $131 million.

Shares in the Company's common stock that are repurchased are considered treasury stock. The timing and actual

number of additional shares repurchased will depend on a variety of factors, including the operating needs of the

business, legal requirements, price, and economic and market conditions. On December 10, 2013, our Board of Directors

approved a new share repurchase program authorizing the Company to repurchase up to $3.5 billion of its Class A

common stock. During January 2014, the Company exhausted its purchases under the February 2013 Share Repurchase

Program and began purchasing shares under the December 2013 Share Repurchase Program. As of January 24, 2014,

the cumulative repurchases by the Company under both the February 2013 Share Repurchase Program and December

2013 Share Repurchase Program in 2014 totaled approximately 4.2 million shares of Class A common stock for an

aggregate cost of approximately $351 million, at an average price of $83.00 per share of Class A common stock. As

of January 24, 2014, the Company had approximately $3.3 billion remaining under the December 2013 Share Repurchase

Program.

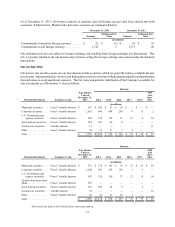

The following table summarizes the Company's share repurchase authorizations of its Class A common stock through

December 31, 2013, as well as historical purchases:

Authorization Dates

December

2013 February

2013 June

2012 April

20111Total

(in millions, except average price data)

Board authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,500 $ 2,000 $ 1,500 $ 2,000 $ 9,000

Remaining authorization at December 31, 2012 . . . . . ** ** $ 604 $ — $ 604

Dollar-value of shares repurchased in 2013. . . . . . . . . $ — $ 1,839 $ 604 $ — $ 2,443

Remaining authorization at December 31, 2013 . . . . . $ 3,500 $ 161 $ — $ — $ 3,661

Shares repurchased in 2013 . . . . . . . . . . . . . . . . . . . . . — 29.2 11.7 — 40.9

Average price paid per share in 2013. . . . . . . . . . . . . . $ — $ 63.01 $ 51.72 $ — $ 59.78

** Not applicable

1 The initial authorization in September 2010 for $1 billion was amended in April 2011 to increase the authorization to $2 billion.