MasterCard 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

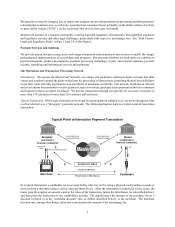

Interchange Fees. Interchange fees represent a sharing of a portion of payments system costs among the issuers and

acquirers participating in our four-party payments system. They reflect the value merchants receive from accepting

our products and play a key role in balancing the costs consumers and merchants pay. We do not earn revenues from

interchange fees. Generally, interchange fees are collected from acquirers and paid to issuers to reimburse the issuers

for a portion of the costs incurred by them in providing services that benefit all participants in the system, including

acquirers and merchants. In some circumstances, such as cash withdrawal transactions, this situation is reversed and

interchange fees are paid by issuers to acquirers. We or financial institutions establish “default interchange fees” that

apply when there are no other established settlement terms in place between an issuer and an acquirer. We administer

the collection and remittance of interchange fees through the settlement process. Interchange fees can be a significant

component of the merchant discount rate, and therefore of the costs that merchants pay to accept electronic payments.

These fees are currently subject to regulatory, legislative and/or legal challenges in a number of jurisdictions. See “Risk

Factors-Legal and Regulatory Risks” in Part I, Item 1A.

Merchant Discount Rate. The merchant discount rate is established by the acquirer to cover its costs of both participating

in the four-party system and providing services rendered to merchants. The rate takes into consideration the amount

of the interchange fee which the acquirer generally pays to the issuer.

Additional Fees and Economic Considerations. Among the parties in a four-party system, various types of fees may

be charged to different constituents for various services. Acquirers may charge merchants processing and related fees

in addition to the merchant discount rate. Issuers may also charge cardholders fees for the transaction, including, for

example, fees for extending revolving credit. As described below, we charge issuers and acquirers fees for the transaction

processing and related services we provide.

In a four-party payments system, the economics of a payment transaction relative to MasterCard vary widely depending

on such factors as whether the transaction is domestic (and, if it is domestic, the country in which it takes place) or

cross-border, whether it is a point-of-sale purchase transaction or cash withdrawal, and whether the transaction is

processed over our network or a third-party network or is handled solely by a financial institution that is both the

acquirer for the merchant and the issuer to the cardholder (an “on-us” transaction).

MasterCard Network Architecture. The MasterCard Network features a globally integrated structure that provides

scale for our issuer customers, enabling them to expand into regional and global markets. It features an intelligent

architecture that enables the network to adapt to the needs of each transaction by blending two distinct processing

structures-distributed (peer-to-peer) and centralized (hub-and-spoke):

• Transactions that require fast, reliable processing, such as those submitted using a contactless card or device

at a toll booth, can use the network's distributed processing structure, ensuring they are processed close to

where the transaction occurred.

• Transactions that require value-added processing, such as real-time access to transaction data for fraud scoring

or rewards at the point-of-sale, or customization of transaction data for unique consumer-spending controls,

use the network's centralized processing structure, ensuring advanced processing services are applied to the

transaction.

Our network’s architecture enables us to connect all parties regardless of whether the transaction is occurring at a

traditional physical location, at an ATM, on the internet or through a connected device. It has 24-hour a day availability

and world-class response time. The network incorporates multiple layers of protection, both for continuity purposes

and to address cyber-security challenges. We engage in multiple efforts to mitigate against such challenges, including

regularly testing our systems to address potential vulnerabilities.

Participation Standards. We establish, apply and enforce standards surrounding participation in the MasterCard

payments system. We grant licenses that provide issuers and acquirers that meet specified criteria with certain rights,

including access to the network and usage of cards and payment devices carrying our brands. As a condition of our

licenses, issuers and acquirers agree to comply with our standards surrounding participation and brand usage and

acceptance. We monitor areas of risk exposure and enforce our standards to combat fraudulent, illegal and brand-

damaging activity. Issuers and acquirers are also required to report instances of fraud to us in a timely manner so that

we can monitor trends and initiate action when appropriate.